How Much Age Pension Will I Get + How Can I Maximise It?

Written by: Jayden Scott l Advisory Team

The Centrelink Age Pension is a social security payment provided by the Australian Government to eligible individuals and couples who have reached retirement age and have limited income and assets. This payment is designed to act as a “safety net” by providing financial support to those who are unable to work full-time and do not have sufficient financial resources to support themselves in retirement.

The payment amounts for the Centrelink Age Pension are adjusted every six months in line with changes to the cost of living. As of March 2023, the maximum payment amounts for the Age Pension are as follows:

- Single Person: $1,064 per fortnight

- Couple (combined): $1,604 per fortnight

Age Pension Eligibility Criteria

Depending on your situation, you may be eligible for a full payment or a partial Age Pension if you meet the eligibility criteria relating to your age, residency, income and assets.

- Age: the eligibility age for the Age Pension is gradually increasing from 65 years to 67 years. Currently, the eligibility age at the time of writing (March 2023) is 66 years and 6 months. This is set to increase to 67 years by 1 July 2023.

- Residency: to be eligible, you must be an Australian resident and meet certain residency requirements. Specifically, you must have been an Australian resident for a minimum of ten years, or for at least five years if you have a qualifying residence exception.

- Income and Assets: your income and assets will be assessed to determine your eligibility for the Age Pension and to then calculate the rate of pension payable based on these figures.

How Age Pension Payments Are Calculated

Income Test

The Income Test considers many forms of income, including wages, superannuation pension payments, rental income, and more. Centrelink also uses deeming rates to calculate the income that you receive from financial assets (such as bank accounts, managed funds and shares) and you will include this in your assessable income.

When assessing an individual’s eligibility, the first $190 of income for a single person or $336 for a couple (combined) does not affect your pension entitlements. This means that you would be eligible for the full Age Pension, based on solely the Income Test, if your fortnightly income is below those levels. However, every dollar of income over the relevant thresholds will reduce your pension payment by 50 cents per fortnight. The fortnightly income cut off point is $2,318 for a single person and $3,544 for a couple (combined) living together. These cut-off points are variable in certain circumstances, such as for Disability Support Pensions or for couples who are separated due to ill health.

Asset Test

The Asset Test considered the total value of your assets, including but not limited to:

- Financial investments (such as managed funds, term deposits or shares);

- Home contents;

- Vehicles;

- Real estate;

- Annuities;

- Superannuation pensions; and

- The value of your equity in a business (sole traders, partnerships, private trusts and private companies are all included).

Any debt that you owe that an assessable asset is security for is deducted from the market value of the asset. The value of an unsecured loan may also be deducted from the value of assessable assets.

There are two main categories that change the value of assets you can own before your eligibility or the full or even part age pension eases. Centrelink will assess the value of your assets differently depending on whether you are a homeowner or a non-homeowner, and whether you are single or in a couple.

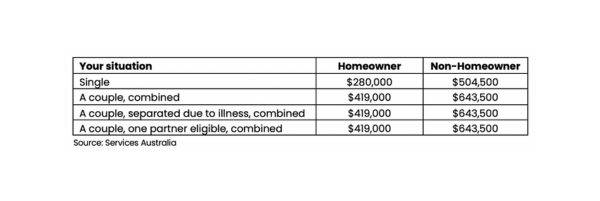

To be eligible for the full age pension, your assets must be below the value in the category in which you call under:

If your assets exceed these thresholds, your Age Pension entitlement will reduce by $3 per fortnight for every $1,000 your assets exceed the threshold. it is important to note that not all assets are assessed under the Age Pension asset test. These include but are not limited to, your family home and certain types of superannuation accounts.

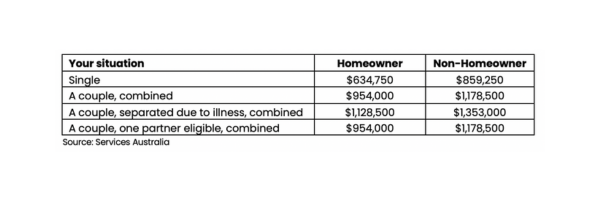

The maximum value of assessable assets you can own before you are no longer eligible for a part-age pension are as follows:

When assessing your eligibility for the Age Pension, Centrelink will determine your payment based on the lowest entitlement from the Income and Asset tests. For example, if the Income Test says you are eligible for $700 per fortnight, but your Asset Test determines that you’re eligible for $500 per fortnight, you will only be eligible for a maximum entitlement of $500 per fortnight.

Maximising Your Age Pension Entitlements

There are some methods that can be used if you are slightly above a certain threshold or you are simply looking to maximise your Age Pension entitlements. Of course, it is not recommended to spend all your liquid assets with the intention of receiving the full Age Pension, as even the maximum Age Pension is not sufficient during your retirement. However, there are some effective ways to increase your entitlements for the Age Pension without having an effect on your existing financial position.

- Purchasing a Lifetime Annuity is a viable option for reducing both your assessable income and assets. As of 1 July 2019, only 60% of the payment you receive from a Lifetime Annuity is assessable income under the Income Test. Furthermore, only 60% of the purchase price of the Lifetime Annuity is assessable under the asset test. The rules can be complex around this, however, and there are many factors that can affect the assessable value of a Lifetime Annuity.

- Another way to increase your eligibility for the Age Pension is to shift a portion of your superannuation to a younger spouse’s super fund. This is particularly useful because superannuation is not an assessable asset while you’re under Age Pension age, making this particularly beneficial for couples who have an age gap between them.

- The value of a pre-paid funeral bond is not an assessable asset under the Age Pension asset test. By using part of your assessable liquid assets to purchase a pre-paid funeral bond could reduce your assessable assets significantly. Hence, you will receive a greater fortnightly payment from the Age Pension and have the peace of mind of having a pre-paid funeral bond in place for your family. Therefore, if you haven’t thought about purchasing a pre-paid bond this may be something that’s worth thinking about.

- Many of these ideas we talk about involve reducing your assessable assets in one way or another. However, if your home is due for some renovations, now also might be the time to consider pulling the trigger. The value of your family home is exempt from the Age Pension asset test. Continuing what we have just talked about with the pre-paid funeral bond, you could use some of that assessable cash that you have sitting in an account to increase the value of your asset test-exempt family home while increasing your fortnightly payments from the Age Pension.

Canny Advisory + The Age Pension

As you can see, preparing thoroughly for your Age Pension application could make a huge difference to the outcome of your application. There are lots of different rules to consider and many strategies that could significantly improve your income levels in retirement.

If you are reading age 67 and think you could be eligible for the Age Pension, get in touch with our team at Canny Group and organise a meeting with one of our friendly financial advisers who can assist you through an Age Pension application and look at strategies to increase the pension payments you are entitled to receive.