What To Include In Your Prenuptial Agreement

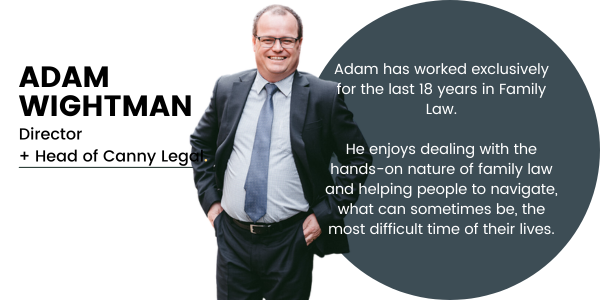

Written by: Adam Wightman | Legal Team

Most people have heard of prenuptial agreements, or ‘prenups’ as they are called on TV shows and movies.

However, people are often confused as to whether prenuptial agreements exist in Australia and whether or not they are actually legally binding. The answer to both of those questions is ‘Yes’!

People also often wonder what can and should be included in prenuptial agreements. The answer to that question is ‘it depends on what you want to achieve’.

Prenuptial agreements, known formally as Binding Financial Agreements, offer a solution that enables you to preserve your assets and wealth from a potential future family property settlement claim in the event that you separate from your de facto partner or spouse.

A prenuptial agreement is a legally binding document established and signed by a couple whilst they are still in a relationship. Whilst the term ‘prenuptial agreement’ is commonly used to describe a type of Binding Financial Agreement made in no contemplation of an impending marriage, they can also be signed by parties who have no intention of ever marrying but instead continue to live in a de facto relationship (also known as ‘Cohabitation Agreements’). Prenuptial agreements may be signed before the parties start living together, after they have commenced living together, and even after they have married.

Prenuptial agreements typically outline how financial matters will be handled in the event of separation and/or divorce, covering areas such as property, inheritance, income, and businesses acquired before or during the de facto relationship and/or marriage.

Who Can Enter into a Prenuptial Agreement?

Many people incorrectly assume that prenuptial agreements are just for wealthy couples, or situations where one person has significantly greater assets than the other. However, this is not always the case, as prenuptial agreements can be entered into by any couple, from all walks of life, and with all levels of wealth.

There is no minimum amount of assets or income that either partner or spouse must hold before they can enter into a prenuptial agreement. In fact, some couples can enter into prenuptial agreements to protect their projected future wealth, in circumstances where they may not currently hold many assets of significance (although this is not always advised on a cost-benefit analysis).

Prenuptial agreements can also provide peace of mind to the children from a first marriage that their inheritance will be preserved as their parents embark on a new relationship later in life. This is one of the most common situations where a prenuptial agreement is utilised. The other most common scenario is where one (or both) of the partners have accumulated significant assets prior to the relationship.

Separation can be made clear with a prenuptial agreement, however, if you’re wondering how these decisions can affect your children, take a look at another of our articles! When Can My Child Decide Who They Live With?

What Can Prenuptial Agreements Provide For + What Should They Include?

Prenuptial agreements can provide the framework for the division of your assets, liabilities, financial resources and income in the event of a separation.

Prenuptial agreements will typically provide a mechanism by which the assets that each party introduces into the relationship (and assets subsequently purchased using those introduced assets) will be protected/quarantined from any possible future family law property settlement. Prenuptial agreements can also provide a mechanism by which the income, assets and liabilities accumulated by the parties during the relationship, and even after separation, will be divided, in the event of a separation.

Prenuptial agreements also provide the only possible complete protection against either making a claim against the other for spousal maintenance (ongoing financial support paid by one spouse to the other after separation) into the future. Such a complete protection against spousal maintenance is not provided by The Family Court system, and can only be achieved through the use of a Binding Financial Agreement. This can offer extremely valuable protection for people earning considerably higher incomes than their partners.

Prenuptial agreements can include whatever types of provisions the parties agree upon. However, things to keep in mind when instructing your lawyer to draft up a prenuptial agreement are:

- Do you wish to exclude from the division the assets that you both introduced at the commencement of the relationship?

If so, then how do you want to deal with the scenario where one party sells an introduced asset to purchase another asset during the relationship? How do you want to deal with the scenario where one party introduced an asset during the relationship subject to a liability that that party and/or the other party pay off during the relationship?

- How do you wish to have assets dealt with that are purchased jointly by the parties during the relationship, in the event of a separation?

For example, would all jointly held assets be divided on an equal 50/50 basis, or on some other percentage basis? Alternatively, would you seek to divide the assets on the basis of the ‘financial contributions’ made by each party to its acquisition, and if so, do ‘financial contributions’ include both introduced assets and income earned during the relationship?

- Are all jointly owned assets to be sold as part of a separation, or would either party be given the chance to ‘buy out’ the other spouse?

If so, how do you determine what the asset is worth?

- Who is going to reside in the family home immediately following a separation, and how long would they be given to vacate the premises, if this is required?

- How are you going to deal with superannuation and other investments that may increase in value considerably during the relationship as a result of a natural increase in value and/or further contributions made to them by the parties from their income?

- Is the agreement going to provide for a different type of division of assets depending on how long the relationship lasts, or whether there are children of the relationship?

- Is one spouse going to provide the other with financial support in the event of separation, and if so, how much and for how long?

Will this vary depending on the length of the relationship and whether or not there are children?

How Do I Get A Prenuptial Agreement?

In order for a prenuptial agreement to become binding, each party must agree to sign the documents, freely, voluntarily and without any form of duress being applied to them. Further, each party must have received independent legal advice from their own separate lawyer regarding the nature and effect of the agreement and the advantages and disadvantages of signing the agreement. Each party’s lawyer must also sign a certificate annexed to the agreement confirming that they have provided this advice.

Therefore, before entering into a Binding Financial Agreement it is important to ensure that both parties understand the terms of the agreement and how it will operate throughout the relationship and in the event of a separation. It is also vital that each partner has their own separate lawyer (from different law firms) to provide them with independent legal advice.

Canny Legal + Navigating Family Law

The family lawyers at Canny Legal are experts at drafting all forms of Binding Financial Agreements, from cohabitation agreements, and prenuptial agreements, through to agreements made during a marriage.

If you have commenced living with your partner, or if you are contemplating commencing living with your partner, then please contact Canny Legal to find out how a Binding Financial Agreement may help you to enjoy a worry-free relationship.

Get in touch with our team if you are looking for guidance on your prenuptial agreements.