How To Financially Prepare For Retirement

Written by: Canny Advisory

Retirement Planning is one of the most rewarding areas of advice for me that I like to work with, both with new clients and those that are long-term clients. For longer-term clients, it is great to have them on the journey working up to retirement, so you can see them start to enjoy the fruits of their (and our team’s) labour.

Did we hit their targets? If yes, why, and if not, why not? It’s these things that help us to be able to improve as a financial planner and ensure that every client we deal with, ends up being in a better position for having seen one of our team. Were we able to get our client more in the aged pension? Were they able to travel overseas every two years as they wanted? Were they able to help their kids out with their first home? That’s the other thing I like about Retirement Planning, each and every case is different from the one before. For some people, Retirement Planning can be the great unknown – when can I retire? How much do I need? What can I do to put myself in a better position?

Each and every one of those questions is good and very important questions on its own, which is exactly why we have put this article together to try to help you understand how to financially prepare for your retirement.

Retirement Planning Advice: When Can I Retire?

There is a common misconception by people that they are until to retire until they hit age 67 – which is the age most people will be entitled to the age pension moving forward. Some people think it is age 65 – the age at which you can have unrestricted access to your superannuation, even if you’re still working.

The great news is that anyone can retire today, regardless of age! The downside of this is that you are not eligible to access superannuation until you’ve met what is called a ‘condition of release’.

The most common conditions of release for paying benefits are that the member:

- Has reached their preservation age and retires;

- Has reached their preservation age and begins a transition-to-retirement income stream;

- Ceases an employment arrangement on or after the age of 60;

- Is 65 years old (even if they haven’t retired); and/or

- Has come terminally ill or dead.

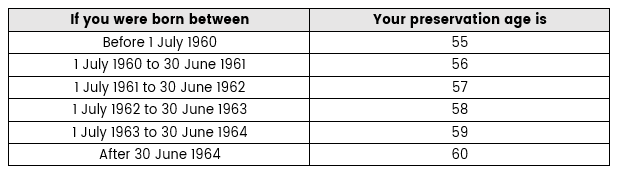

Preservation Age Based on Date of Birth

Date of Birth = Preservation Age

If you decide to retire prior to meeting a preservation age, you will need to self-fund, via other savings or assets until you are eligible to access your superannuation funds.

Financial Planning: How Much Do I Need?

Hands down this is probably the most common question that I get from clients, and I have a fantastic answer! For some reason, the media always touts this magic $1 million dollar figure that people need in retirement and I’m not sure where they get this from.

A better way to look at it is what kind of income you want to generate in retirement, and we can work backwards from there! If you need $40,000 per year, you definitely don’t need a million. If you want $120,000 per year, you’re going to need substantially more than $1,000,000.

Singles

According to some research done by the Australian Superannuation Fund Association’s Retirement Standard, to enjoy a comfortable retirement singles aged 65 years old need $545,000 to generate an income just under $44,000. Couples on the other hand would need around $640,000 which would allow them to generate an income of just over $62,000. This assumes that these groups are homeowners and do not need to fund rent payments or pay mortgages. The reason for these levels of sums is due to potential Centrelink Entitlements that might need to come into play.

If we looked at this example, a single person with $545,000 in superannuation, $5,000 in the bank and $5,000 in contents with a $10,000 car would receive approximately $2,000 per annum, meaning they’d need to generate $42,000 from their super funds. At an average return of 6% after fees and taxes, drawing this level from super would see their funds last over 23 years, not taking into consideration the higher age pension entitlements as their assets decrease.

Couples

For the couple, with $640,000 in superannuation; 2 x $10,000 cars, $10,000 in contents and $10,000 in the bank, they would receive approximately $16,500 combined, meaning they’d need to generate $45,500 from their superannuation. Let’s assume this couple is more conservative than the single above, and only achieved a return of 4% after fees and taxes. Drawing at that level would see their capital last for just over 26 years, again not taking into consideration the higher age pension entitlements as their assets decrease. This also ignores other strategies we could look at and products we can utilise to improve these Centrelink Entitlements.

The above examples show that you might not need as much money as you think you do to retire. I’ve been lucky enough to work with some individuals and couples in the last few years that have thought they’d have to work a few more years before even considering retirement, whilst after really looking into it, we’ve been able to help them retire almost immediately.

Set Financial Goals:

What Can I Do To Put Myself In A Better Position?

This is a great question, and it doesn’t matter if you’re ten years out from retirement, five years, or you’ve just handed in your notice. The great part of Retirement Planning is there is always something you can do better yourself. From saving fees on funds to sheltering assets from Centrelink, reducing taxes paid by your estate, helping out the kids, or even using super to pay down debt whilst still working. There are so many varying scopes of advice that it’s overwhelming and seeking advice from one of the Financial Advisors at Canny Advisory can put you in a significantly better position.

There is a strategy called Transition to Retirement, whereby those that have met a condition of release can access up to 10% of their fund balance each year, which allows them to salary sacrifice a large amount back into superannuation.

There are several benefits here including reduced income taxes and fast-tracking your retirement savings. This strategy can also be employed to fast track loan repayments if that is your preference. Given that interest rates are at an all-time low, there are arguments to say that you’re better off putting more money into super depending on your risk tolerance as you could earn more than you could save. These are all scenarios that can be explored with the team at Canny Advisory.

Currently, for non-dependants, if you were to pass away and they receive your superannuation monies, they would lose 17% of the taxable component in tax (superannuation money can be taxable or tax-free).

For example, if you had $200,000 in super and it was $150,000 taxable and $50,000 tax-free, and you passed away and it went to your adult son or adult daughter, they would receive $25,500 less, due to these taxes. There is a strategy that we could look to utilise assuming you met the criteria that would allow us to potentially reduce these taxes down to zero over one or multiple financial years. Again, everyone’s situation is different, and it is important to seek financial advice before making any of these decisions.

- Sheltering Assets From Centrelink

Currently, superannuation is only an assessable asset from Centrelink for those over aged pension age. Oftentimes, in couples, one partner can be younger than the other. This opens up an opportunity to shelter some super/savings from an assessable state to a non-assessable state.

I had a case recently where a person just eligible for the age pension has a wife five years younger. By receiving some advice, we were able to organise it so the husband was able to receive approximately $12,000 a year from Centrelink that he wouldn’t have otherwise been entitled to, due to the level of assets he had that were assessable. This may not always be applicable depending on your personal situation and the makeup of your assets or age.

Retirement Planning with Canny Group

I know that we’ve covered a lot here and it may be overwhelming, but the good news is that regardless of your current situation, how old you are when you want to retire, the level of income you may need in retirement, it’s never too late to seek advice to be able to put yourself into a strong position.

If you have any questions about any of this, or something not covered, please get in touch with the Advisory team at Canny Advisory and we can help put you on the path to your desired retirement.