The Coronavirus [COVID-19] has had a significant impact on financial markets and global asset prices. With wider economic and social disruption now evident and expected to continue in the short-term. We understand that you may have concerns about the effects this pandemic and subsequent disruptions may have on your superannuation balance. That’s why we’re going to talk about how to remain calm amid this crisis and avoid becoming an ‘April Fool’ when it comes to your retirement savings.

CONSIDERATIONS for investors?

It’s important to remember that superannuation is and always has been a long-term investment. With that in mind, long-term performance is one of the key factors to consider during events like this. While it’s confronting to see the global market experience a downturn of this scale, we remain confident this trend will reverse, as we have seen on previous occasions.

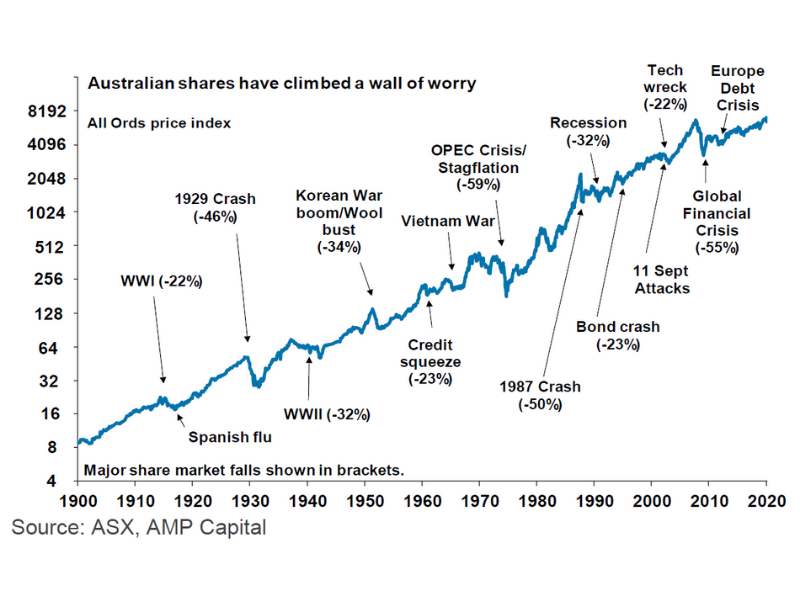

There’s no doubt this Coronavirus pandemic is a serious event. However, as a result of this, we’re likely to see global fiscal stimulus, low valuations on equities and low interest rates for a long time. Another thing to bear in mind is that the world economy has experienced and overcome many challenging events over the last 100 years, including World War I and World War II, the Spanish flu, the Great Depression and more recently the 2008 Global Financial Crisis [GFC]. The below graph demonstrates how shares climb a “wall of worry” over many years with numerous events pulling them down periodically. As we can see, the long-term trend of shares is ultimately upward while providing greater returns than other more stable assets. The takeaway message from this is that periods of volatility are the price we pay for higher longer-term returns from the share market.

WHAT CAN I DO… to protect my superannuation?

We mention the above because as we experienced during the 2008 Global Financial Crisis [GFC], many investors are now electing to switch their superannuation investments to cash or very defensive options in search of lower volatility and greater stability. Unfortunately, it’s near impossible to predict when market confidence will return and recover. As a result, efforts to mitigate risk by attempting to time market movements simply lock-in, and in many cases, magnify losses. For example, the share market fell some 40% in 2008-9, but recovered near all of the fall in the following 12 months, and subsequently went on to exceed the pre-GFC levels.

The Coronavirus pandemic has escalated rapidly during the early months of 2020, resulting in the fastest share market drop of this magnitude in history. It has left us all questioning how long this will last and when global markets will rebound and return to pre-COVID-19 levels. The sharp market falls and headlines blaring that billions of dollars have been wiped off the share market are stressful for all of us. It’s only natural to want to take action and do something about it to protect your retirement savings. However, if history is any indication, those who are unlikely to draw on their superannuation in the short-term are often best to take no action. We know it may seem counter-intuitive, but panicking and switching your superannuation investments to cash or very defensive options in the midst of a market downturn can lock-in losses and significantly impact your retirement savings in the long-run.

In times like this, it’s often best to turn down the noise. We have always recovered, and we’re confident that we will come through this crisis as we have in previous times. With this in mind, we encourage you to consider your immediate and long-term requirements. As always, you should also continually consider your own objectives, financial situations and needs which are not addressed in this general article. If you have any concerns or queries, please don’t hesitate to contact us and we will discuss your personal circumstances in more detail.

Stay healthy + safe!

Chris Graham – Client Services