Do you ever stop to think about what you would do if you were suddenly unable to produce an income?

Financial worry is the leading cause of stress among Australian’s, that’s while in the capacity to earn an income. Statistics suggest that most of us put our ability to survive on no income at less than a month. So it’s a wonder that we don’t do more about it.

We talk freely of different insurances to protect assets, such as the house or car. But not so much about protecting our biggest asset – ourselves. While thinking about becoming seriously unwell or sustaining a life altering injury isn’t a great thought, the reality is it can and does happen. Planning for the ‘what if’ has the ability to provide a silver lining in what would already be a heartbreaking and life changing situation.

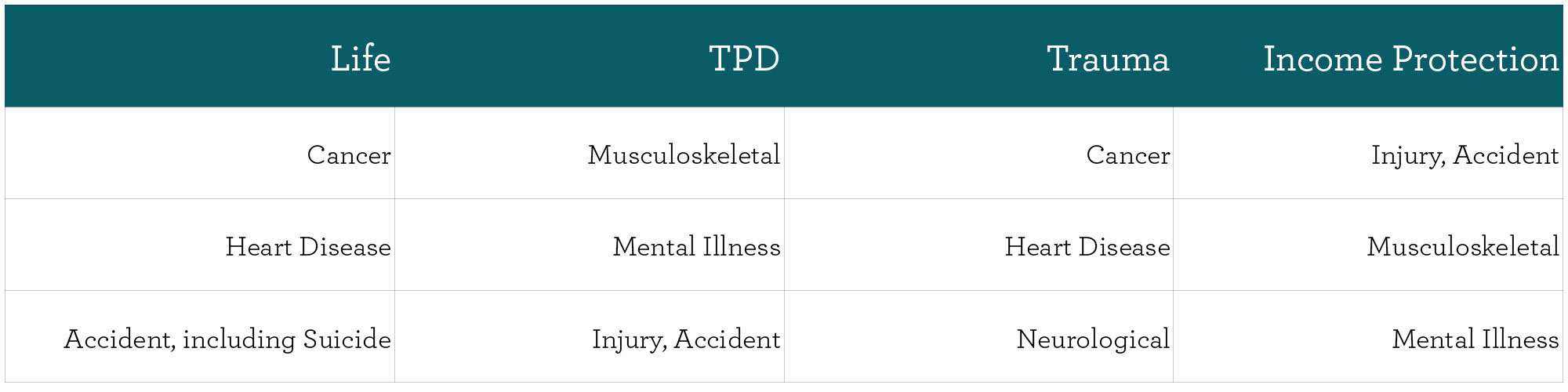

You may already be aware that there are four main types of personal insurance; Life, Total and Permanent Disablement (TPD), Income Protection and Trauma Cover.

Leading causes of claims

Why do I need personal insurance?

With the above in mind, could you afford to maintain your current lifestyle if one of those was to happen to you as well as the costs associated with your recovery?

Even in your 20’s when you may have minimal responsibilities, having some type of personal insurance in place to pay for your lifestyle and/or outstanding debts may be a better option than relying on and placing that financial strain on parents. And for the parents, what would your child do if they became sick or injured? So often now when they’re supposed to be thinking about their own retirement, parent are having to take on financial responsibility of their children who haven’t protected themselves. Having the conversation about personal insurance may prove to be an economical one to encourage with them.

How much do I need?

It’s hard enough to get people to think about their superannuation alone. However, many of us may be aware and probably have some type of personal insurance in our super fund. While an Income Protection policy will cover up to 75% of your wage, knowing what insurances you have and whether the policy benefit is enough should be regularly reviewed.

NOTE: A Trauma policy cannot be held in super.

When considering your Life and TPD policies, think carefully about three principal areas;

- What would be needed to cover any immediate costs? As well as that of a funeral in the event that you did pass away.

- How much is required to pay off any existing debts? Such as a mortgage.

- How much would be needed in legacy? Such as the amount required to pay for your child or children’s education and lifestyle as they grow up.

Time to do something about your personal insurance?

Personal Insurance is very tailored. Knowing what type of policy would be most beneficial, the benefit amount to have and the best provider for you and your circumstances, are all factors we will work out with you.

If your policy has been in place for some time, there is every chance it may not reflect your current circumstances. Things like changes in income level, assets/liabilities, marital situation, family members and so on are triggers that should prompt a review.

If you would like more information or to schedule an appointment, please call our office on 03 5278 9500 or send an enquiry.