Your 2022-23 Federal Budget Breakdown

As the post-pandemic economic recovery continues to take shape, Australia Federal Treasurer Josh Frydenberg has handed down the 2022-23 Federal Budget

Among the proposed changes, Australia Federal Treasurer Josh Frydenberg has announced a temporary cut to fuel excise, help for home buyers and extended relief for retirees, as well as a one-off cost of living payments to millions of Australians. It is important to remember, that many of these proposals could change as legislation passes through parliament.

Superannuation

1. Temporarily Extending the Minimum Pension Drawdown Relief

Proposed effective date: 1 July 2022

The temporary reduction to the minimum income drawdown requirement for superannuation pensions will be further extended until 30 June 2023.

This will allow people to minimise the need to sell down assets given ongoing market volatility. It applies to account-based, transition to retirement and term allocated superannuation pensions.

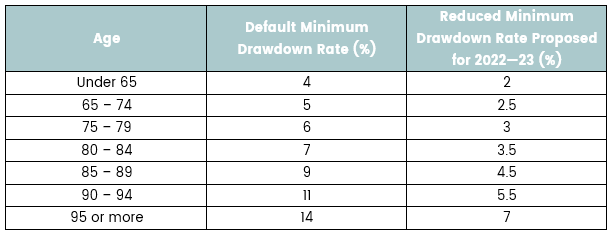

For the 2022-23 financial year, the proposed minimum pension drawdown will be:

Tax

1. Temporarily Cutting Fuel Excise

Proposed effective date: 30 March 2022

Fuel excise will temporarily be cut by half, or 22.1 cents per litre, to save families an estimated $30 a week. This measure will end on 28 September 2022.

2. Increasing the Low and Middle Income Tax Offset (LMITO)

Proposed effective date: 1 July 2021

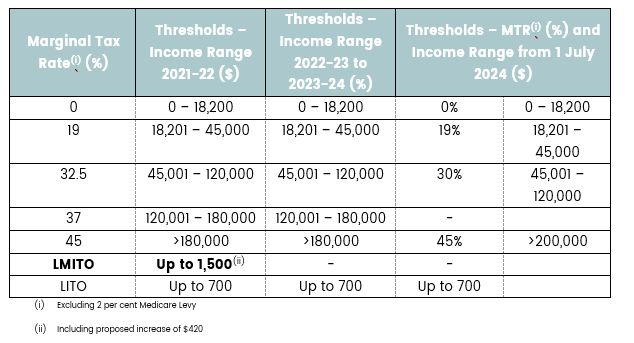

- The LMITO will be increased to up to $1,500 for the 2021-22 financial year. All eligible LMITO recipients will benefit from the full $420 increase, referred to as the Cost of Living Tax Offset.

- The benefits for those earning up to $37,000 and $48,000, the offset will increase at the rate of 7.5 centre per $1 above $37,000 to a maximum of $1,500 (currently $1,080).

- Those earnings between $48,000 and $90,000 are eligible for the maximum LMITO benefit of $1,500 (currently $1,080).

- For income above $90,000, the offset phases out at a rate of 3 cents per $1 and is not available when taxable income exceeds #126,000.

- The LMITO is due to end on 30 June 2022 and has not been extended.

Personal tax rates, thresholds and offsets

The Low Income Tax Offset (LITO) remains unchanged at $700 and will be reduced at a rate of:

- 5 cents per $1 for income between $37,500 and $45,000; and

- 1.5 cents per $1 for income between $45,000 and $66,667.

Effective tax-free threshold (2021-22) with LMITO and LITO:

- $25,437 for individuals below Age Pension age (some Medicare levy may be payable)

3. Increasing the Medicare Levy Low-Income Thresholds

Proposed effective date: 1 July 2021

Low-income taxpayers will generally continue to be exempt from paying the Medicare levy.

The threshold for:

- Singles will be increased from $23,226 to $23,365

- Families will be increased from $39,167 to $39,402

- Single Seniors and Pensioners will be increased from $36,705 to $36,925

- Families (Seniors and Pensioners) will be increased from $51,094 to $51,401. For each dependent child or student, the family income thresholds increase by a further $3,619.

Social Security, Families + Aged Care

1. Introducing A One-Off Cost of Living Payment

Proposed effective date: 28 April 2022 onwards

To help with the higher cost of living pressures, the Government will provide a one-off tax-free payment of $250 to Australians who receive qualifying social security payments or hold eligible concession cards, including:

- Age Pension

- Disability Support Pension

- Carer Payment

- Carer Allowance Jobseeker Payment

- Pensioner Concession Cardholders

- Commonwealth Seniors Health Card Holders

An individual can only receive one payment, even if they’re eligible for multiple benefits or concession cards.

2. Enhancing the Paid Parental Leave Scheme

Proposed effective date: 1 July 2023

Currently, the Paid Parental Leave scheme is made up of two payments for eligible carers of a newborn or recently adopted child:

- Parental Leave Pay of up to 18 weeks at a rate based on the national minimum wage

- Dad and Partner Pay of up to two weeks at a rate based on the national minimum wage

The Government plans to create a single scheme of up to 20 weeks, fully flexible and shareable for working parents within two years of their child’s birth or adoption. Single parents will also benefit from the extended 20-week entitlement.

The income test will also be broadened. Parents who don’t meet the individual income threshold (currently $151,350) can still qualify for payment if they meet a family income threshold of $350,000 a year.

3. Lowering the Pharmaceutical Benefits Scheme (PBS) Threshold

Effective date: 1 July 2022

The Government will reduce the PBS safety net thresholds to support people who have a high demand for prescription medicines due to their health needs.

This means approximately 12 fewer scripts for concessional patients and 2 fewer scripts for general patients a year.

On reaching the PBS safety net, concessional patients will receive their PBS medicines at no cost for the rest of the year, and general patients will pay the concessional co-payment rate (currently $6.80 per prescription).

Housing Affordability

1. Expanding the Home Guarantee Scheme

Proposed effective date: 1 July 2022 -OR- 1 October 2022 depending on the specific scheme

The Home Guarantee Scheme allows first home buyers to build or purchase a newly built home with a low deposit, replacing the need for commercial lenders’ mortgage insurance.

The Government is expanding the scheme to make available:

- 35,000 guarantees each year (up from the current 10,000) from 1 July 2022 under the First Home Guarantee, to support eligible first home buyers to build or purchase a newly built home with a deposit as low as 5%.

- 10,000 guarantees each year from 1 July 2022 to 30 June 2025 to expand the Family Home Guarantee. This program enables eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%.

Eligible first home buyers may also be able to take advantage of the First Home Super Saver Scheme which allows them to use the concessionally taxed super system to save their first home deposit.

Other federal and state grants and stamp duty concessions may also be available.