Age Pension + Financial Advisory Services

Written by: Samantha Butcher l Advisory Team

The purpose of the age pension payment/benefit is simple – it is designed to provide income support to older Australians who need it while encouraging pensioners to maximise their overall income. The Age Pension is paid to people who meet age and residency requirements, subject to a means test and the pension rates are indexed to ensure they keep pace with Australian price and wage increases. So while that reads simple enough, we often find that our clients find the task of applying for the age pension to be daunting, and/or are often finding themselves getting confused by the rules!

Applying for the age pension can represent a new and exciting stage of your life, as it is often associated with the prospect of finishing work, or perhaps you have already stopped working a long time ago, but you have now become eligible based on your age and you can now enjoy some benefits, compliments of the government. Regardless of how you got there, our team at Canny Advisory are here to help you through every step of the process, should you want and even need help to ensure that you are receiving what you are entitled to.

Questions that we often hear our clients asking include, but are certainly not limited to;

My partner is not yet eligible for the Age Pension so why do I need to provide his/her details?

Can I still work and will it affect my pension?

Can I give some money to my children?

Will I automatically receive the Age Pension?

What benefits do I get with the pensioner card?

If you find yourself asking the same sort of questions, we’re going to go into detail on the Aged Pension, covering off from start to finish, what you need to know!

Eligibility/Disclosure of Details

- Age Pension age in Australia is gradually increasing to the point that everyone born from 1 January 1957 will need to be 67 years old before they become eligible to apply.

- As with other pensions that are provided by Services Australia, the Age Pension is means-tested and an applicant’s entitlement is subject to both an income and assets test.

- For couples, all assets and income must be declared, regardless of whether the spouse is eligible or not. It does not matter who owns the asset. Your financial adviser can provide potential strategies to help to reduce your assessable assets/income and therefore increase your entitlement.

Financial Goals

Working Beyond Age Pension Age

It is a common misconception that individuals, particularly those of Age Pension age, who earn an income from employment cannot qualify for a Centrelink payment. Another misconception is that taking up paid employment while being in receipt of a Centrelink entitlement will automatically result in loss of that payment. In fact, the opposite is true – the government offers incentives to encourage workforce participation while still providing a level of social security benefits as a safety net where a person’s assessable income is below certain thresholds.

Employment income for social security purposes refers to income derived from paid work undertaken by an employee or, for self-employed individuals, net income after expenses incurred are deducted from business profits.

What is Considered Employment Income?

Common examples of employment income include, but again, are not limited to:

- Salary and Wages, including penalty rates and overtime

- Commissions

- Director’s Fees

- Bonus Payments

- Employment-related fringe benefits

- Leave Payments (including annual leave, long service leave, personal leave and leave loading)

Employment income can be in the form of money or valuable consideration (such as fringe benefits) and can be derived within or outside of Australia.

How Much Can I Earn Before My Pension Is Affected?

The government introduced the work bonus scheme to provide an incentive for pensioners over Age Pension age to participate in the workforce, should they choose to do so.

Essentially the first $300 p/fortnight ($7,800 p.a) of a person’s employment income or self-employment income, is disregarded under the income test. Any unused part of the $300 fortnightly work bonus exemption amount accrues in an income bank, up to a maximum of $7,800. The income bank amounts offset future employment or self-employment income from the pension income test. The income bank amount is not time-limited and carries forward.

Conversely, any employment or again, self-employment income over $300 p/fortnight is assessed under the income test (unless one has accumulated an income bank).

Investment Management + Gifting

What is a ‘Gift’?

Essentially, gifting occurs when you give away a financial asset for less than its market value.

Examples of assets that can be gifted include:

- Cash

- Transferring an asset to another person (other than spouse) for no consideration

- Transferring an asset to another person (other than spouse) for less than market value

- Donating money or assets to a charity including offerings made at a church or similar institution

- Forgiving a loan

- Relinquishing money or assets into a family trust or company that you (or your partner) does not control

- Transferring the family home without adequate consideration (unless a granny flat interest is established)

Please note, assets given away because of a court order or formal property settlement following relationship breakdown, are not subject to the gifting rules.

Your money is yours and technically you can give away as much as you would like to. However, there is a cap on the amount by which a gift will reduce a person’s social security assessable income and assets, thereby increasing entitlements. You can give away up to $10,000 each financial year, with a maximum $30,000 over five financial years rolling period. These limits apply to a couple i.e. the maximum is $10,000 combined, not $10,000 each. This includes a couple who are considered illness separated as they are also limited to $30,000 over a five-year period – not $60,000.

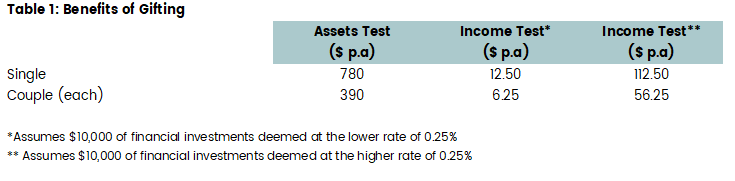

Benefits of Gifting

If you are a part pensioner, gifting the maximum $10,000 in a financial year will result in the following annual increase to your entitlement depending on whether you are income or asset tested (up to the maximum pension payment):

Retirement Planning

What Other Benefits Do I Get With The Pension Card?

As long as you are eligible for a part pension, you will be issued with a pensioner card. This card can provide potentially many hundreds of dollars worth of discounts and savings every year and definitely shouldn’t be overlooked if you are eligible.

Some key benefits include:

- Cheaper medicine under the Pharmaceutical Benefits Scheme

- Bulk Billed doctor visits – this is up to the discretion of your doctor

- Emergency ambulance transport

- Free hearing services

- Potential reduction in utility bills

- Potential reduction in property and water rates

- Reduced motor vehicle registration

- Discounts on public transport

Financial Advisory Services + Canny Group

Our team of qualified financial advisers have had many years of combined experience dealing with Centrelink and can help you to navigate the system to make the transition to Age Pension as seamless as possible. We can also provide tailored advice on strategies to maximise your entitlement. Not only will we work with you during the application stage, but we can also become a Centrelink nominee for you which enables us to contact Centrelink on your behalf at all times.

Get in touch with us today to find out how we can help!