Are Electric Cars Soon To Be FBT Free?

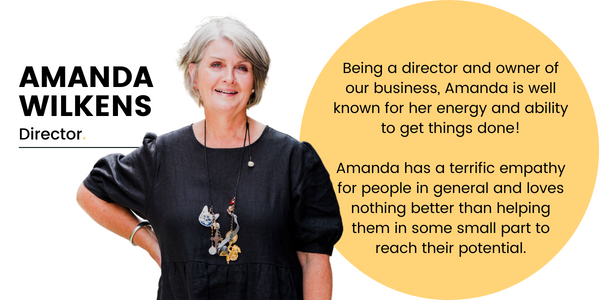

Written by: Amanda Wilkens l Accounting Team

In recent years, the world has witnessed a significant shift towards sustainable and eco-friendly technologies. As the country grapples with the challenges posed by climate change and pollution, promoting electric vehicles (EVs) has emerged as a critical strategy. Promising cleaner air, and quieter streets and encouraging you to play your part in the war against fossil fuels and climate change, it is a cleaner and greener way of community and therefore better for the environment.

Countries such as Norway, The Netherlands and Sweden have already blazed the way by offering substantial incentives to electric car buyers such as tax breaks, reduced tolls and free parking.

Finally, Australia has caught up. To help promote individuals and companies to switch to fuel-efficient vehicles to reduce emission levels, the Australian Tax Office (ATO) has backdated legislation to 1st July 2022. From that date, employers do not pay Fringe Benefits Tax (FBT) on eligible electric cars and associated car expenses provided to employees.

Let’s Talk Fringe Benefits Tax…

Fringe Benefits Tax (FBT) is a tax imposed by the Australian Government on certain benefits provided to employees in addition to their regular salary or wages. These benefits can include items such as company cars, housing allowances, entertainment and more.

Australia faces a unique set of challenges in the promotion of electric vehicles.

The vast geographical expanse of the country demands a robust charging infrastructure to alleviate range anxiety and make electric vehicle ownership feasible for individuals and businesses alike. Furthermore, the upfront costs of electric vehicles remain a deterrent for many potential buyers. However, the Government’s Fringe Benefits Tax incentive has emerged as a catalyst, mitigating some of these challenges and making the transition to electric vehicles more attractive.

For employers, providing electric vehicles as company cars can result in reduced Fringe Benefits Tax (FBT)liability. The lower Fringe Benefits Tax rates for electric vehicles not only save companies money but also align with their corporate social responsibility goals. By incorporating electric vehicles into their fleets, businesses can demonstrate their commitment to environmental sustainability, enhancing their public image and attracting environmentally conscious customers.

Eligibility for FBT Savings

For a car to be eligible for this Fringe Benefits Tax saving, the vehicle has to meet the following conditions:

- The car is a zero or low emissions vehicle (currently: battery electric vehicle, hydrogen fuel cell electric vehicle or plug-in hybrid electric vehicle);

- Designed to carry a load less than one tonne;

- The first time the car is both held and used is on or after 1 July 2022;

- The car is used by a current employee or their associates (such as family members); and

- Luxury Car Tax (LCT) has never been payable on the importation or sale of the car (the current 2023-2024 luxury car tax threshold for fuel-efficient vehicles is $89,332). All commercial vehicles are exempt.

The costs to run the car are exempt as well, which makes it even more attractive. These costs include:

- Registration;

- Insurance;

- Repairs and/or maintenance; and

- Fuel (including electricity to charge and run electric cars).

Reportable Fringe Benefits (RFBA)

While the provision of an electric car itself is exempt from Fringe Benefits Tax, there is still a requirement to include the amount in the calculation of Reportable Fringe Benefits (RFBA) if the total taxable value of the benefit is over $2,000 in an FBT year. Your RFBA is ‘grossed-up’ to reflect the pre-tax income you would have had to earn, at the highest marginal tax rate (plus Medicare levy), to buy the benefit yourself. Although the amount of RFBA is not added to an employee’s taxable income for determining their income tax or Medicare levy liabilities, it is used by the ATO and Centrelink to determine certain obligations such as:

- Medicare levy surcharge;

- your entitlement to private health insurance rebate;

- HECS repayments;

- Eligibility for Family Tax Benefit Part A and B and

- Child Care Subsidy amongst other things.

What About A Novated Lease?

Being exempt from Fringe Benefits Tax would mean that the average employee would not only save on their marginal tax bracket but on the GST when purchasing and subsequent running costs as well if they enter into a novated lease arrangement with their employer.

A novated lease offers a way for individuals to enjoy the benefits of their vehicle ownership while minimising the financial burden and maximising tax advantages. Offering electric vehicles as part of a salary packaging or leasing arrangement can reduce the upfront cost for employees. Under a novated lease arrangement, the employee and employer enter into an agreement where the employer makes lease payments from the employee’s pre-tax salary. This effectively reduces the employee’s taxable income, leading to lower income tax payments. The employer reduces the amount to be repaid by the employee by the employer claiming the GST credits on the vehicle purchase price and operating costs.

Novated lease arrangements often include not only the lease payments but also maintenance, registration, insurance and roadside assistance. If an employee changes jobs, the novated lease can be transferred to the new employer thus minimising disruptions to the leasing arrangement. Traditionally, Fringe Benefits Tax is tax paid by employers for the personal use that an employee has of the vehicle. it is calculated based on the taxable value, this is avoided and therefore reduces the cost to the employee.

Canny Accounting + Your FBT Needs

In Australia, the introduction of the fringe benefits tax exemption for electric vehicles has added another layer of encouragement for businesses to make the transition to sustainable transportation. As many more companies embrace these vehicles, the positive impact on the environment, the economy and an employee’s hip pocket will become more pronounced. The path to greener, cleaner and more efficient transportation is well underway.

Our team of accountants at Canny Group is versed in all areas of Fringe Benefits Tax. If you are looking for some help to ensure a seamless FBT year, and you are looking at the inclusion of electric vehicles to add to your fleet offering for your employees, get in touch with our team so we can help you from the start.