Director Identification Numbers – Accountants Geelong l Canny Group

Are you a director of a company? It’s time to get ready for the launch of Director ID!

As we come together to begin the potentially long COVID-19 road to recovery, the Federal Government is making some crucial changes to minimise fraud and protect the privacy and security of Australian directors.

Part of this process has been the introduction of Director Identification Numbers (DIN) – a unique identifier that a director will keep indefinitely. This initiative has been designed to help stamp out illegal phoenixing and other fraudulent activity, enabling the government to verify and track individual directors’ corporate history accurately.

It is critical to understand your new obligations as a director, as failure to apply for a Director Identification Number (DIN) within the required time frame will leave you open to criminal and civil penalties.

The new regime, passed in Parliament in June 2020 and it is expected to cover over 2.5 million directors or roughly 10 per cent of Australia’s 25.7 million population.

So, if you are a director or support your organisation’s directors, you must get across the requirements and prepare yourself for what is to come. Applications open on 1 November 2021, so it’s time to get cracking!

Government Locks In Director Identification Number Deadline

Existing company directors will now be required to apply for a director identification number (DIN) by 30 November 2022, while directors of Indigenous corporations that are governed by the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act) will be required to apply for the unique identified by 30 November 2023.

Applications for a Director Identification Number are free and as previously mentioned, will open this month on the newly established Australian Business Registry Services (ABRS), a single platform administered by the Commissioner of Taxation that brings together ASIC’s 31 business registers and the Australian Business Register.

Company directors must apply for their director ID themselves and will be required to produce their myGovID alongside two identifying documents from a list including:

- Bank Account Details

- Super Account Details

- ATO Notice of Assessment

- Dividend Statement

- Centrelink Payment Summary

- PAYG Payment Summary

When Do You Need To Apply?

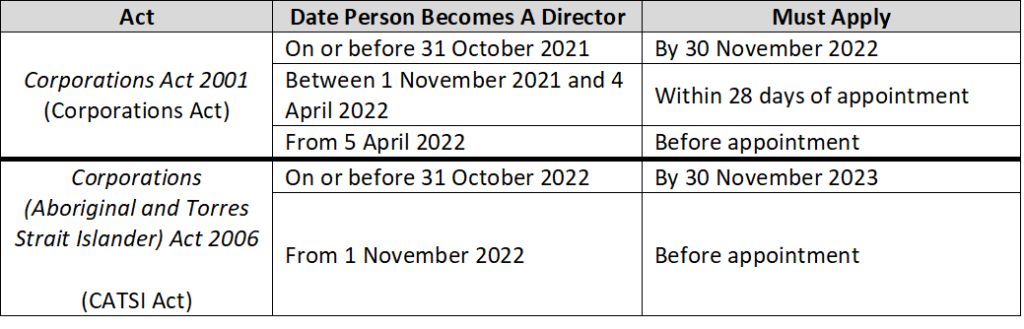

When you need to apply is dependant on the date you were appointed as a director:

- Existing Directors

Appointed on or before 31 October 2021 will have until 30 November 2022 to apply and to be able to apply from 1 November 2021. So, we suggest that you sign up for your myGovID now in preparation for the changes.

- New Directors

Appointed between 1 November 2021 and 4 April 2022 will need to apply for their Director ID within 28 days of their appointment. From April 5 2022, you will need to apply before your appointment.

What You Need To Do As Of 1 November 2021?

Individuals who are currently a director or will be acting as a director in the future must apply for a Director ID based on the transitional arrangements specified in the table below:

How Do Individuals Apply Online For A Director ID?

If you haven’t already done so – it’s time to now apply for a myGovID number (this is not to be confused with the MyGov platform).

This will ensure you are ready to use the Director ID platform when it is launched. To understand how to get started, visit the myGovID website here.

- Go to the ABRS website to access the ABRS Director ID services and learn about the Director ID requirements

- Verify your identity using your myGovID credentials or create a myGovID using your smartphone and Australian identity documents. For more information visit how to set up myGovID

- Conduct a proof of record ownership by answering two questions about the individual’s ATO record

- Complete a Director ID Application on the ABRS platform to receive the Director ID instantly

Who is Entitled to an Extension?

At this stage, the Australian Tax Office (ATO) has confirmed that there will be a process to apply for an extension of time for specific organisations and situations.

- New Directors

New Directors facing a rapidly approaching 28-day deadline may experience administrative hurdles in applying.

- Foreign Directors

Foreign Directors of corporations operating in Australia are likely to encounter registration challenges as these directors won’t have access to the myGovID platform. These non-Australian citizens will be able to apply via a paper-based application process.

- Charities + Not For Profit

Charities and Not-For-Profits may require extra support during the transition to Director ID due to resource restraints; they may be entitled to apply for an extension if needed.

What Are The Penalties for Non-Compliance?

Civil and criminal penalties will apply where individuals:

- Fail to apply for a Director Identification Number within the prescribed time frames or if directed by the Regulator to do so;

- Intentionally apply for more than one Director Identification Number;

- Provide a false Director Identification Number; and

- Are actively involved in the infringement of any of the above offences.

Under the law, company directors who fail to apply for a director ID within the stipulated time frame can face criminal and civil penalties of 5,000 penalty units, which currently stands at $1.11 million. Company directors of a CATSI organisation can face penalties of up to $200,000.

Penalties will also apply for conduct that undermines the new requirements, including providing false identity information to the registrar or intentionally applying for multiple director IDs.

Canny Group Taxation Services + Your Director Identification Number

Canny Group is here to help you through the steps of these new requirements. However, this is not something that we can do for you on your behalf as a company director. We can, however, ensure that you are across all of your responsibilities as a company director and ensure that you understand these new responsibilities. Get in touch with our team if you have any questions as we are always happy to help you through the process.