Business Tips for NDIS Service Providers

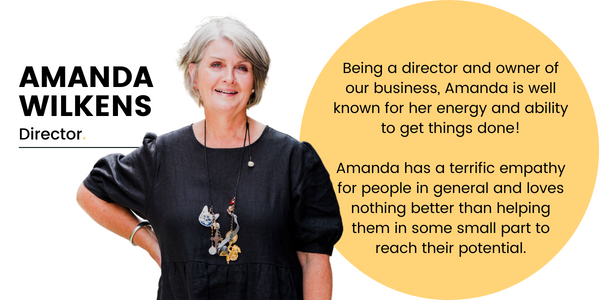

Written by: Amanda Wilkens l Accounting Team

The National Disability Insurance Scheme is now well known to many of us with over 484,000 NDIS Participants since its inception in 2013. Likewise, there has been enormous growth in small businesses that provide support and services to those same NDIS Participants.

Being a small business in this space has a lot of responsibilities and means that you need to consider structure, tax compliance for GST and income tax as well as payroll if you are an employer. Budgeting and planning are essential and you also need to consider if you will be NDIS Registered or not.

Let’s take a look at what you need to consider from start to finish when it comes to being in business as NDIS Service Providers…

Let’s Look at Structure… Specifically Business Structures

Consider whether you will operate as a sole proprietor, partnership, company or trust (to name a few). Let’s get into the options;

A sole proprietor is one business owner operating under their own Australian Business Number (ABN). The income and expenses of the business are declared on their personal income tax return and tax is paid accordingly.

A partnership is more than one business owner. Commonly there will be two owners and the income and expenses of the business are split in two and 50% of the net profit or loss is declared by each owner in their tax return. The partnership will have its own Australian Business Number (ABN).

If you are considering asset protection, a company may be the best choice for you. The company is registered with ASIC – The Australian Securities and Investments Commission, and declares its income and expenditure and pays tax on the net profit at a flat rate of 25%. The company will have its own Australian Business Number (ABN).

Also, along the asset protection lines are trusts. The trust will distribute the net profit made in the business to the beneficiaries of the trust. Usually, this is the main business person, along with the other family members. The trust will have its own Australian Business Number (ABN).

Income tax on the profit is paid at your marginal rate when you are a sole proprietor, receiving a distribution from a partnership or a trust.

Should You Become A Registered NDIS Provider?

To be registered with the NDIS or not be registered… that is the question!

This is a question that you need to give consideration to as both sides have equal opportunities. If you choose to register your business with the National Disability Insurance Agency, you are able to work directly with NDIS Participants which can allow for business growth. Better yet, if your NDIS Participants are approved for NDIS Plan Management within their budgets this means that you are able to request your invoice payments directly to their chosen NDIS Plan Manager and be paid directly from their NDIS Plan.

Something to take into consideration if you are thinking about becoming a registered NDIS provider is the registration process. If you choose to be registered with the National Disability Insurance Scheme, you need to ensure that you are set up to be able to comply with audits, as well, the registration process itself can be costly and your fees will be subject to the NDIS Price Guide.

If you choose not to be a registered NDIS Provider, this is still a great option, it just means that you will be limited to the NDIS Participants that you are able to work with and that is dependent on how their NDIS Plan is managed i.e. Self-Managed, Plan Managed or Agency Managed (NDIA Managed).

NDIS + GST: How Does GST Fit In?

To GST or not to GST… that is the question!

Another consideration is GST – if your business will turn over more than $75,000 in a single financial year, you have to register for GST. Regardless of if the type of income you are receiving is a GST-free supply. Once you are registered for GST, you will have an obligation to lodge a Business Activity Statement (BAS) each month, quarter, or year – depending on what your preference is. On this Business Activity Statement (BAS), you will declare the income you have received, the expenses and payroll that you have incurred and you will repay the GST collected, minus the GST incurred.

You will also pay any tax deducted from your employee’s wages if applicable. This is called PAYG Withholding. When you are a supplier of disability supports and registered for GST, your supplies (income) to an NDIS Participant may be GST-free. You may also supply a mix of taxable and GST-free services.

The following criteria determines if you have provided a GST-free service:

- The NDIS Participant has a current NDIS Plan; and

- The supply or service if os reasonable and necessary supports that are specified in the statement of supports in the NDIS Participants NDIS Plan; and

- There is a written service agreement between you and the NDIS Participant or another representative such as a registered NDIS Plan Management provider, the National Disability Insurance Agency (NDIA) or a guardian or relative of the NDIS Participant; and

- It is a supply covered by one of the tables in the Disability Services Minister’s Determination.

Already an NDIS service provider and not sure if you should be charging GST? Check out this blog we put together called, To GST or Not To GST, That Is The Question! to give you a better insight into what you can and can’t charge GST for when it comes to the NDIS.

Bringing In Someone To Help In Your Business

If you are going to employ people in your business to help you operate, you will have to register with the Australian Tax Office (ATO) to let them know. There are two registrations that are to assist with reporting your pay runs to the ATO in real time:

When employing team members, you will not only pay their wages but also a minimum of 10.5% superannuation and you will need to register with WorkSafe Victoria. These are extra considerations to the cash flow of your business.

Looking At Financial Records To Figure Out If You’re Actually Making A Profit?

After getting advice on the appropriate business structure to suit your circumstances and obtaining the registrations with the ATO and WorkCover that you need, next you should give some thought to planning for cash flow. This is commonly called budgeting or cash flow forecasting.

It makes good business sense to map out the coming year with the known costs that you will have, plan for extraordinary purchases (say a new vehicle or computer equipment) and then work out if your income will cover what your spending requires. If not, what are you going to do to generate the extra income or does it mean the spending will have to be postponed? If you don’t plan you are flying blind and then there is the surprise of how much tax you will have to pay at the end of the year as, unlike employees, the tax on the business is your responsibility.

Canny Group + Your NDIS Business

We have many business clients that are providing NDIS services. We love working with them because we understand this space. From getting the business set up correctly at the very beginning to helping them grow and expand. We are there for you, in every part of the journey.

If you are thinking of going into business as an NDIS Provider, get in touch with our team so we can help you to get onto the right track to business success.