How To Give Your Business The Best Opportunity To Succeed

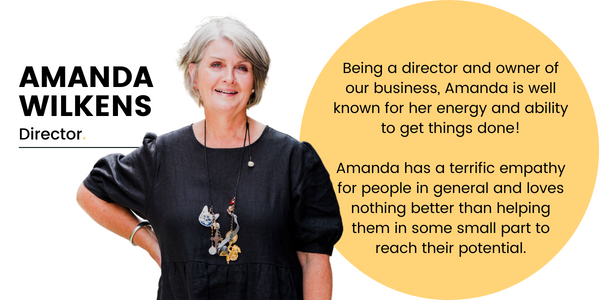

Written by: Amanda Wilkens l Accounting Team

I am often heard to say;

“You should look at your business as a tree. You need to keep the tree really healthy so that you can pick and enjoy the fruit from it”.

So, in order to keep your business healthy so that you will reap the rewards of your success, you need to regularly review it to make sure that it is performing at its optimum.

This is good advice when you are just starting out and a good reminder if you are already on your business journey. Here are seven steps that you can take to make sure your business has every opportunity to succeed and remember that each of these steps is relevant if you are considering a new business or if you are already operating it.

Seven Steps For Starting A New Business + Operating Your Current Business

Step One: Evaluate Your Situation

Before you start making changes, it’s a good idea to make sure you have a full understanding of the very fundamentals of your business. You need to be very clear –

- What am I selling?

- Who am I selling it to?

- How do I reach them?

Once this is bedded down, it is a good idea to make sure that the legal structure under which your business operates is suitable. This should be set up properly at the start and be reviewed during your business journey to make sure that it is still working to your advantage. It could be time to change from a sole proprietor to a company, partnership or trust. It could be time to change because your business is growing and you are considering taking another person into your business.

Step Two: Analysis

- SWOT Analysis – helps you identify your business’s strengths, weaknesses, opportunities and threats

- Benchmarking – measures your business’s performance against similar-sized businesses in your industry

- Market Research – investigates your business’s market and industry to identify trends, changes and customer or client demands

- Trend Analysis – uses business data collected over time to identify consistent results or trends

- Webinars (web-based seminars) and Professional Development – provide useful information to help develop your business skills

- Business Review – seek professional advice along the way from your Accountant (like the team at Canny Accounting) and your Legal Advisor (like the team at Canny Legal) to make sure you are on the right track and that you understand your obligations and what opportunities are available.

Step Three: Set Clear Goals

Start with broad goals and then narrow them down to a manageable and achievable ‘to-do’ list. Prioritise them and work out which goals needs to be concentrated on first.

- Specific – state clearly what you want to achieve

- Measurable – make sure you can evaluate the success

- Achievable – check your objective is something you have the time and resources to meet

- Relevant – make sure your objectives improve profit drivers and improve some part of your business

- Timely – set a specific date for completion

Be committed to making sure that you give them the time they deserve. Your business goals may change over time as your business matures and there is nothing wrong with that, but if you don’t have goals to work towards you can waste time and money operating without a plan. Think of this as your roadmap to success.

Step Four: Be Clear On What You Are Good At

Successful businesses are efficient!

Make sure you only do what you are good at and seek professional advice from your accountant at Canny Accounting and your legal advisor at Canny Legal to make sure you are on the right track and that you understand your obligations and what opportunities are available. Find marketing experts, IT specialists and additional staff to help you when your business can afford it. Support yourself with people who are better and smarter than you and are experts in their field. Having reliable and trustworthy advisers will let you unleash your entrepreneurial skills so that you can continue to have those inspirational ideas that will keep your business current.

Step Five: Cashflow is Queen

Make sure you work with a budget so that there are no surprises!

You can’t grow without cash and your business could close altogether without it. Prepare a cash flow forecast before you begin your business and then you can refine it as you understand your business more and more. Be mindful to keep to your budget and be disciplined about your spending. This is an area that you will need your accountant to help you with. It goes hand-in-hand with managing your risk and ensuring that you have appropriate insurance coverage in the event of an accident or mishap. Your financial planner and an insurance broker can assist you with this as you need to consider the business and the business owners as well.

Step Six: Keep Good Records

Having a beautiful ‘set of books’ won’t make you rich, but it will save you time and effort when you have to provide your information to your accountant, lender, new business partner or prospective purchaser to name a few.

Good record-keeping makes it easier to make business judgements as you have clear and reliable data to make financial decisions with. Record Management is about knowing what you have, where you have it, and also how long you have to keep it.

Even if your financial literacy is low, you should still be able to read a “Profit & Loss” and a “Balance Sheet” and better yet, our team at Canny Accounting can show you how from the start!

Have you considered putting on a bookkeeper? Check out this article that we have put together on How A Bookkeeper Can Improve Your Business – it has everything you need to know if you are on the fence about using a bookkeeper!

Step Seven: Always Keep Learning + Learn From Your Mistakes

Along your business journey, it is likely that you will make decisions and have actions that you regret. You need to be mature and honest and take on board any feedback that is given, be prepared to continually learn new things, be open to giving new ideas a try if they fit with your goals and budget for them accordingly. Experts in every field continue to adapt to new technology which can bring about efficiencies. Also, learn to accept customer feedback and be open to suggestions for improvement. Ask customers and colleagues to make suggestions on how the delivery of your business can be improved. You never know, there could be some amazing, yet simple ideas that could help improve your business.

Canny Group, Your Businesses Success + Much More Than Just Taxation Services

We are here to help and we have been helping our clients for the past 62 years and we have no intention of slowing down.

Get in touch with our team to find out how we can help you with your business and ensure that you are giving it the best opportunity to succeed from the start, the middle or the end depending on where you are on your business journey. Our accounting, legal and financial advisory teams can work together to guide you through any or all of the areas that we have touched on above.