The Role of Financial Advice

Written by: Chris Graham l Advisory Team

With many Australians being affected by the pandemic, financial stress is no doubt on the rise. Over 40% of people reported feeling nervous, restless or exhausted over the last year, according to the Australian Bureau of Statistics.

Your financial health can have a huge impact on your mental health. That’s why this RU OK? Day, it’s important to stay connected and check up on your own finances as well.

Chair of the ‘RU OK?’ Conversation Think Tank, Kamal Sarma, says now more than ever, “we need to partially distance ourselves but socially connect.”

“People are affected a lot by their finances, mentally. It can create a lot of worry and concern. For example, if you’re near retirement and you see your nest egg dropping in value or you’ve lost your job, that can be really challenging,” Sarma says.

The Impact of Financial Health + Wellbeing

People are complex; our thoughts, feelings, and behaviours on all matters in life are linked and interact together to impact our overall health and wellbeing. The way we think about situations affects how we feel emotionally which, in turn, affects our behaviour. This is the theory behind cognitive behaviour therapy in psychology and is a helpful framework that can be applied to thinking about money.

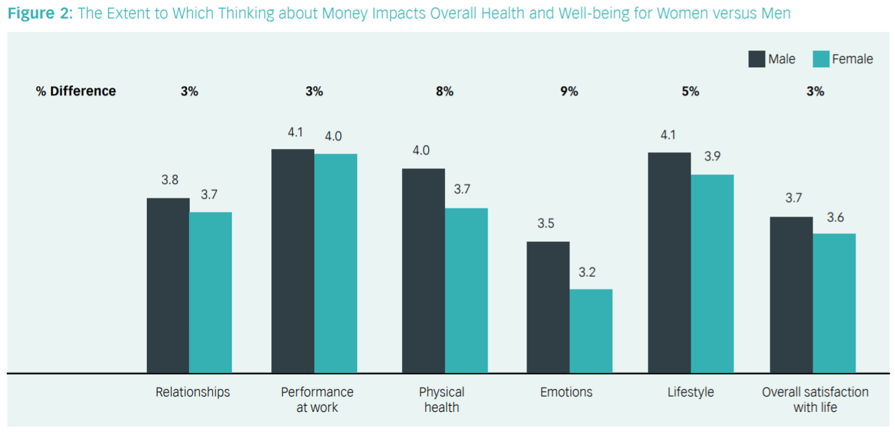

A study conducted by the Beddoes Institute confirms that thinking about money can have a negative impact on our overall health and well-being. The study found that:

- Women are more adversely impacted than men, especially in relation to their emotional health (i.e., they are more likely to feel sad, stressed, and anxious by thinking about money).

- Individuals with low financial literacy are more adversely impacted than those with strong financial literacy across all health and well-being dimensions but especially in terms of emotional health; and

- Women with low financial literacy are more impacted than men with low financial literacy in terms of their emotional health (i.e., they are more likely to feel sad, stressed, and anxious as well as eat badly, drink more alcohol and exercise less as a result of thinking about money) and have lower overall satisfaction with life.

The Important Role of Financial Professionals

This study has successfully quantified the value of financial advice showing that one’s financial management ability improves significantly over the course of the advice relationship – up to 24% for men and 27% for women overall.

Gen Y women’s financial management skills improve more as a result of financial advice than men of a similar age (Gen Y women up 35% and Gen Y men up 19%). Gen X women benefit most of all from financial advice (42% improvement for women and a 24% improvement for men) while Baby Boomer women appear to benefit least from financial advice, albeit still significantly valuable (up 24% for men and 19% for women).

Interestingly, individuals who have the lowest confidence with regards to financial management at the beginning of the advice relationship are the ones that benefit most from financial advice. Adults that rated themselves very poor at poor at the outset shows a 44% improvement in financial management ability, those that rated themselves as fair showed a 26% improvement while those that rated themselves as good or very good showed a 5% improvement.

In addition, it appears that formal education has little impact on one’s ability to manage finances. Importantly, this finding shows that financial advisers are for everyone regardless of education, existing financial literacy, and money management ability.

These findings provide empirical evidence of the substantial benefits of working with a financial adviser.

It shows that the financial education resulting from an advice relationship leads to increased confidence, empowerment, and an ability to make better financial decisions.

This means that the significant detrimental impact of thinking about money on health and well-being is likely to be minimised for Australians receiving ongoing financial advice. Financial advisers, like the team at Canny Group, play a significant role in contributing to the health and well-being of the Australian community.

Creating Your Financial Plan

Here at Canny Group our financial advisers can help to create a financial plan to achieve your goals so that you can spend less time thinking about money and more time focussing on what’s important to you.

Retirement Planning

We can help you with your important retirement planning questions such as:

- Where should I retire?

- How much money will I need for retirement?

- Will I be eligible for Government entitlements?

- How and when should I begin to access my superannuation?

Retirement planning is something that you need to consider while you’re still working and contributing to superannuation. It’s important to have the right financial strategy in place well before your anticipated retirement date. This will ensure that you are maximising your resources and boosting your retirement savings in the most effective way possible in your pre-retirement years.

We recently took a deep dive into retirement planning and superannuation with a blog and also getting the most out of (in to) superannuation that is a fantastic insight into retirement planning and getting a great understanding of where to start!

Investment Management Tips for Savings + Investments

We can also help you with your savings and investments. There are a few different ways you can make investments that give your savings a boost and grow your overall wealth. The first place is to identify your risk profile. Investing is risky; this is because there is uncertainty around how the investment will perform over the short and long term. The risk scale will determine whether you are more of a conservative investor or an aggressive investor. Our financial advisers will help you to navigate the uncertainty of investing so that you can have the peace of mind knowing that your savings and investment plan is working for you to achieve your goals.

Financial Advisory Services for Insurance + Protection

Furthermore, we can help to ensure that you and your family are financial protected. Having insurance in place is your best option for protecting you and your family – your most valuable asset. Understanding the different types of personal insurance and the exact cover you have are key components to good financial management. There are four main types of personal insurance;

- Life Insurance

- Total and Permanent Disablement (TPD)

- Income Protection Insurance

- Trauma Cover

Canny Advisory + Your Financial Planning Journey

Want to know more about creating a financial plan for your retirement, savings and investments or personal insurance? Get in touch with us today to arrange a meeting with one of our financial advisers to discuss how we can help you to create a financial plan so that you can spend less time thinking about money and more time focussing on what’s important to you.