What Happens If My Business Partner Becomes Incapacitated?

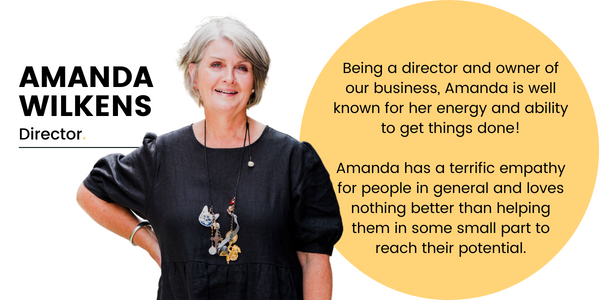

Written by: Amanda Wilkens l Accounting Team

When starting a business with someone else, it is essential to have a partner who can help you to make decisions and manage the day-to-day operations. This helps to ensure that the business is running smoothly and is successful. Often a partner has a speciality or skill or client relationships that they bring to the business that perhaps the other business owners do not.

There are multiple things that you have on your to-do list before you “open the doors” of your new business or find your groove in the specific business offering that you are showcasing to the world. Things like working out the best fitting business structure, if you are going to be employing people – employment contracts, registering your business name, obtaining your ABN – the list goes on and on.

However, one thing that is almost never on that ‘to-do list’ is ensuring that you are covered and have had “the talk” about what would happen if one partner becomes incapacitated due to illness, injury or death. While it might not be an easy conversation to have (and is a tad on the morbid side) – it is a conversation that every business owner should be having if they haven’t already.

Let’s Talk About The Partnership

If one partner was to become incapacitated, the business could be affected in a few different ways.

Depending on the type of business, the incapacitated partner may not be able to contribute to certain decisions, such as financial decisions or major decisions that affect the business. If the partner is unable to participate, the other partner will have to make decisions on their own or with the help of other advisers.

You will need to decide who will manage the finances of the business, who will do the day-to-day work of the business and will the business have enough money to continue without the other owner.

Check Your Business Agreements

If the incapacitated partner is a shareholder, the other partner may have to purchase the incapacitated partner’s shares. Finding the funds for this can be stressful in an already worrying time. No one ever thinks this will happen to them, but business is filled with uncertainty and it is more common than you think. To avoid any ‘knee-jerk’ decisions, that are often made under pressure, there are some sensible things that you can do to be prepared and have a plan in place in case you find yourself in this position.

Buy-Sell Agreement

When starting a business (or when bringing in a partner) an agreement such as a buy-sell agreement is essential.

This will stipulate what should happen if a partner wants to exit the business if there is another person coming into the business and what steps are to be taken in the event that a partner or key person becomes incapacitated. It may reference the appointment of a representative to manage the business in the absence of the incapacitated partner. This representative should be someone who is trusted by the partners and has the business’s best interest in mind. The representative should be able to make decisions about the business as if they were the incapacitated partner.

You also need to cover what would happen to the partner’s share of the business if one partner passed away. Who would inherit each business partner’s shares and would all other partners be comfortable working with this person? Would you be able to afford to pay out a partner’s share if this happened?

The agreement should cover all contingencies often referred to as the five D’s:

- Death;

- Divorce;

- Drugs;

- Disinterest; and

- Disability.

These documents are bespoke documents relevant to your business circumstances. This legal document should be reviewed during the life of the business to make sure it remains relevant to the business circumstances.

What About Business Insurance?

Another important factor to consider is having in place an insurance policy to cover the costs associated with the incapacitated partner’s illness or injury.

If one partner becomes incapacitated, it can be a difficult and stressful situation for all involved. However, having the right documents in place can help protect the business and ensure that it continues to run smoothly. It is important to discuss these matters with a trusted business advisor to ensure that the best decisions are being made.

Business partner insurance or Buy/Sell insurance will provide dollar funding to the surviving business partner to buy out the other share of the business. Death, trauma and/or total permanent disablement can all be covered. Another type of insurance that is recommended is disability insurance. This insurance should cover the costs associated with the incapacitated partner’s illness or injury, such as medical expenses, lost wages, and other expenses.

This insurance can help ensure that the business can continue to operate in the event of an incapacitated partner. In addition, life insurance can also be beneficial for business partners. Life insurance can provide financial protection for the surviving partner in the event of the other partner’s death. This can help to ensure that the business is not left in a vulnerable position. It is important for business partners to discuss these matters and create a plan to protect the business in case of an incapacitated partner.

Your financial advisor will be able to calculate the amount of insurance you need to safeguard your business in the event that something should happen to one of the partners (or the key people in your business). A key person can be anyone directly associated with the business whose loss can cause financial strain to the business. not only should you consider a director of the company or a partner but also a key salesperson, key project manager, or someone with specific skills or knowledge which is especially valuable to the company.

Individually, each partner or director should consider personal income protection insurance that would cover the income lost by the incapacitated person.

Canny Accounting Are The Accountant for Small Business

Nobody likes to think of the possibility of illness, disablement or death affecting themselves or one of their partners. Often it is not ‘in the budget’ or one of those things that you will ‘get around to discussing’, but never do. It is not important – until it is, and by then it is too late!

Get in touch to have a conversation with one of our experienced business lawyers at Canny Legal along with our financial advisors at Canny Advisory who will come up with a personalised solution that will suit your business and your particular structure and then you can concentrate on making a successful business that rewards the owners.