Why Do I Have To Pay Child Support + How Much Do I Have To Pay?

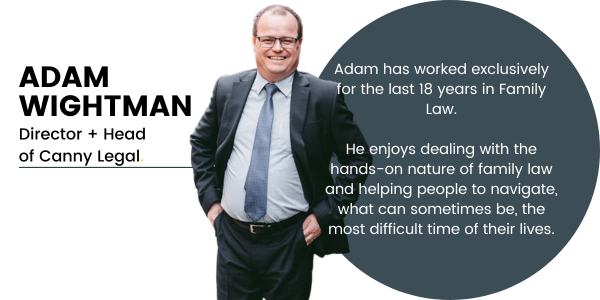

Written by: Adam Wightman l Legal Team

As the great Benjamin Franklin once said:

“In this world, nothing can be said to be certain, except death, taxes and child support.”

…well, perhaps he didn’t say the last two words, however for many parents of children from separated relationships it can certainly feel that way. Many recently separated parents often ask us these questions:

“Why do I have to pay child support?” and “How much do I have to pay?”

The first of these questions is the most straightforward to answer, and the second question involves a little bit of mathematics, and at times, negotiation!

What Is Child Support?

Child Support is the financial support paid by one parent to help with the costs of a child (or multiple children).

Most typically, regular (known as periodic) payments of cash are made from the parent who does not have primary care of the child to the parent who has the primary care of the child to assist the primary carer to pay expenses associated with the child. In some circumstances lump sum (known as ‘non-periodic’) payments are made from the non-primary parent directly towards the payment of specific expenses, such as:

- School fees;

- Books;

- Uniforms;

- Medical expenses; and

- Orthodontic expenses.

Why Do I Have To Pay Child Support?

In short, the law considers that both parents should be financially responsible for the upbringing of children that they share, and as such they should both contribute financially to the payment of the expenses associated with the maintenance of the child.

Therefore, in an effort to ensure that both parents do contribute financially, the government introduced legislation that compels the payment of child support, and this is typically overseen and enforced by the Child Support Agency (known as Services Australia), and in certain scenarios the Family Court.

The child support that one parent pays to the other is considered their contribution to the basic expenses of the child whilst in the care of the other parent such as:

- Housing;

- Clothing;

- Education;

- Transportation;

- Healthcare; and

- Food

How Much Child Support Do I Have To Pay?

The question of how much child support you will be required to pay will depend on the method that the parents agree (or the receiving parent insists upon using) to calculate and enforce the payment of the child support.

The most typical approach requires one parent (usually the parent with the primary care) making a formal application with Services Australia for a ‘Child Support Assessment‘. This process involves Services Australia reviewing the taxable income of each of the parents (as detailed in their income tax returns) and the amount of nights (not days) that the child resides in the care of each of the parents, and the age of children. These factors are applied into a formula which calculates a figure for the periodic child support that one parent must pay to the other on a weekly/fortnightly/monthly basis known as the child ‘support assessment amount’.

In earlier years, the mathematics behind the formula that was applied by the then Child Support Agency, to calculate the child support assessment amount was basic enough that parents and their lawyers could calculate their approximate child support assessment with a pen and paper. However, these days the formula is more intricate, and as such a computer program/calculator is available to be used by the public (for estimation purposes only) and is known as the ‘Child Support Estimator‘ which is located on the Services Australia website.

The Child Support Estimator requires you to enter details of your respective incomes and the ages of your children, and the nights they spend with each parent.

For example:

By way of (completely fictitious) example, John and Sally have two children together aged 7 and 9 who reside primarily with Sally and spend time with John for three nights each alternate weekend during the school term and for some extended time with him on school holidays.

John has a taxable income of $100,000 per annum and Sally has a taxable income of $50,000 per annum. According to the Child Support Estimator, John would be required to pay Sally $438 per fortnight ($11,420 per annum) in child support.

Child Support through the Child Support Agency/Services Australia can either be paid directly from one parent to the other (known as private collection) or it can be paid by one parent to Services Australia, who will then pass it on to the other parent.

Can We Negotiate Outside Of The Child Support Agency/Services Australia?

To utlilise the Child Support Agency/Services Australia Assessment process one parent must initiate the formal assessment process with Services Australia.

However, there is no strict requirement that this process be adopted in all situations. Some parents might have to choose to have a handshake agreement between them both as to the amount of financial support or informal ‘child support’ that they will pay. However, such a handshake agreement is not legally binding.

Binding Child Support Agreements

The only way to make such an agreement about the payment of the child support binding is through a ‘Binding Child Support Agreement’.

Binding Child Support Agreements are complex legal documents that are typically drafted by family lawyers, and have the power of overriding any Services Australia Assessment. Binding Child Support Agreements can provide for the payment of virtually any amount of child support, in whatever format.

For example, under a Binding Child Support Agreement, parties can agree to pay a certain fixed amount of periodic child support and/or they can agree that one parent pay certain non-periodic (lump sum) payments for the children such as a school fees, uniforms, books and medical expenses that may arise from time to time.

Both parents are required to agree on the terms of a Binding Child Support Agreement and also agree to mutually enter into the agreement. Both parents are also required to have independent lawyers who also sign certificates in the Agreement confirming that they have provided the parents with specialised independent legal advice.

For those reasons, Binding Child Support Agreements are often (although not always) negotiated and signed as part of larger family law property settlement/financial settlement negotiations conducted between lawyers.

Child Support + Where Canny Legal Can Help!

Sometimes it’s hard to understand when the right time to reach out to a lawyer can be.

In times of such stress, it’s crucial to know that you can turn to one of the Family Law lawyers at Canny Legal so they can help you deal with the legal stresses that trouble you and you may be facing. Canny Legal has family lawyers who are experts in negotiating and drafting Binding Child Support Agreements.

Get in touch to find out how our team can help you through your child support journey.