Changes To Claiming Working From Home Deductions

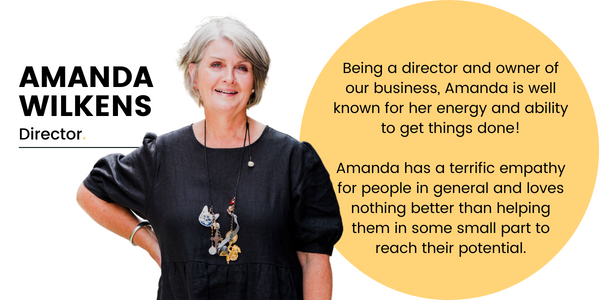

Written by: Amanda Wilkens l Accounting Team

It’s no secret that as we come closer to the end of the financial year that there will be changes to the way in which we are able to claim tax deductions, in the hope of a bigger refund – or for some, a lower payable amount.

While we normally touch on ways to maximise your refund and what the Australian Taxation Office is going to be targeting closer to the end of the financial year, right now there are changes being made in the background and being moved through for approval by the Commissioner which will affect the way that you are able to claim working from home expenses as deductions in your upcoming tax return – and we want you to be prepared!

Eligibility to Claim Working From Home Expenses

So, let’s refresh your memory on how you are able to claim working-from-home expenses.

As per the ATO Website, to claim your working-from-home expenses, you must:

- Be working from home to fulfil your employment duties, not just carrying out minimal tasks, such as occasionally checking emails or taking calls; and

- Incur additional expenses as a result of working from home.

With that, you are able to claim a deduction for the additional running expenses you incur as a result of the time that you are working from the comfort of your own home.

The running expenses are expenses that relate to the use of facilities within your home and include:

- Electricity expenses for heating or cooling and lighting;

- The decline in value of office furniture and furnishings as well as other items used for work – for example, a laptop;

- Internet expenses; and

- Phone expenses.

Previous Ways to Claim Deductions

There are a couple of ways that you are able to calculate the deduction when it comes to your working-from-home claim in your tax return.

Now, you might be thinking “this is what I pay my accountant for” and you’re 100% correct, but it’s important to understand the methods that have previously been used and were available, as this is about to change.

Let’s go into the different types of methods…

Prior to 1 July 2022, to calculate a deduction for expenses incurred as a result of working from home, taxpayers have had the choice of using one of the following methods:

Shortcut Method

Available from 1st March 2020 to 30th June 2022

Allowed 80c per hour for each hour a taxpayer worked from their home to calculate all their additional running expenses, such as electricity and gas expenses (lighting, heating/cool and the use of electronic items used for work), internet expenses, mobile and home telephone expenses, the decline in value of office furniture and furnishings, stationary, computer consumables and the decline in value of a computer, laptop or similar device.

Fixed Rate Method

Available from 1st July 1998 to 30th June 2022

Allowed 52c per hour for each hour a person worked from their home office to calculate their electricity and gas expenses, home office cleaning expenses, stationary, and computer consumables and the decline in value of furniture and furnishings.

In addition, the taxpayer could claim a separate deduction for their work-related internet expenses, mobile and home telephone expenses, stationary, and computer consumables and the decline in value of a computer, laptop or similar device.

Actual Expenses

Required the calculation of actual expenses incurred as a result of working from home.

Changes for Taxpayers + Calculating Work-Related Expenses

Draft Guideline

The draft Guideline outlines the proposed revised fixed-rate method for calculating the work-related additional running expenses incurred as a result of working from home.

As the Shortcut Method ceased to apply after 30 June 2022, from 1 July 2022, taxpayers can:

- Use the revised fixed-rate method as set out in the draft guidelines (see below); or

- Claim actual expenses.

Eligibility to Use The Revised Fixed Rate Method

Taxpayers are only eligible to rely on the Guideline to calculate deductions for additional running expenses using the revised fixed-rate method if they meet all of the following criteria:

To satisfy this criterion, a taxpayer must…

1. Working From Home

Be working from home while carrying out their employment duties on their business on or after 1 July 2022. The work has to be substantive and directly related to the taxpayer’s income-producing activities.

2. Incurring Deductible Additional Running Expenses

Incur additional running expenses. An additional running expense will be incurred when the amount of the expense is actually paid or a definitive obligation to pay the amount of the expense arises.

In circumstances where a third party (e.g. employer) reimburse a taxpayer for additional running expenses, the taxpayer will not satisfy this criterion.

Where invoices and bills are in the name of one member of the household but the cost is shared, each member of the household who contributes to the payment of that expense will be taken to have incurred it.

3. Keeping and Retaining Relevant Records

To satisfy this criterion and to rely on this Guideline, a taxpayer must keep:

- Records showing the total number of hours they worked from home during the income year; and

- One document (e.g. invoice, bill or credit card statement), for each of the listed running expenses which they have incurred during the income year.

In addition, a taxpayer claiming a deduction for the decline in value of depreciating assets used while working from home must keep:

- Documents that meet the requirements of Div 900 (employee) or that meet the requirements of s. 262A of the ITAA 1936 (if carrying on a business); and

- Records that demonstrate their income-producing use of any depreciating assets or other expenses for which deductions are claimed during the relevant income year.

Financial Information for Setting The Records Straight

For the 2022-23 income year only, taxpayers much keep a record that is representative of the total number of hours worked from home during the period 1 July to 31 December 2022, and record of the total number of actual hours worked from home for the period 1 January to 30 June 2023.

For the 2023-34 and later income years, taxpayers must keep a record for the entire income year of the number of hours worked from home (e.g. timesheets, rosters or a diary kept contemporaneously) – i.e. the ATO will not accept an estimate based on hours worked during a shorter period during the income year.

A taxpayer who is not eligible to use the revised fixed rate method, or who is eligible but chooses not to use the method, must use the actual expenses method.

The Revised Fixed Rate Method

The revised fixed-rate method apportions the following additional running expenses on a fair and reasonable basis by using a fixed rate of 67c per hour for each hour a taxpayer worked from home during the income year:

- Energy expenses (electricity and/or gas) for lighting, heating/cooling and electronic items used while working from home;

- Internet expenses;

- Mobile and/or home telephone expenses; and

- Stationary and computer consumables.

What this means is that a taxpayer cannot claim an additional separate deduction for any of these expenses. The revised fixed-rate method does not cover the decline in value of depreciating assets.

A taxpayer’s total deduction for running expenses using the revised fixed-rate method is calculated using the following steps:

- Calculate the number of hours worked from home during the income year based on the taxpayer’s records

- Multiply the total number of hours worked from home during the income year by 67 cents per hour

- Calculate the work-related decline in value of any depreciating assets that are used to work from home during the income year and any other running expenses the taxpayer incurred

- Add the amounts calculated in Steps 2 and 3 – this is the amount the taxpayer claims as a deduction in their income tax return

Canny Accounting + Your Income Tax Return

While this is a lot of information to digest, our team are here to help and to give you a head start to ensure that when the end of the financial year is here, you are able to claim what you are entitled to.

If you have been working from home or you intend to start working from home, the time to start keeping records is now. We’ve put together this downloadable for you to start keeping records for your working-from-home hours to ensure that it satisfies the ATO requirements.

Get in touch with our team today if you have any questions about how this is going to affect you or if you need a hand.