ATO Tax Time Targets for 2023

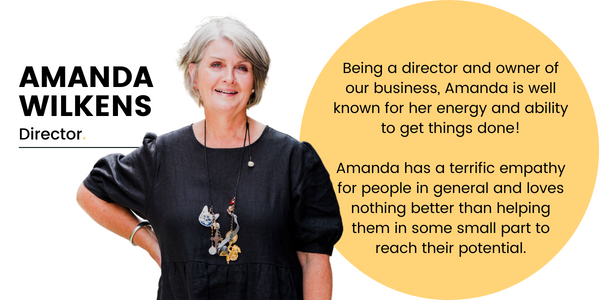

Written by: Amanda Wilkens l Accounting Team

Each year, the Australian Taxation Office has specific items that they put under the microscope and watch closely. In terms of individual income tax deductions, the ATO has announced that it is going to be focusing on four areas for the 2023 financial year:

- Rental Property Deductions;

- Work-Related Expenses;

- Capital Gains Tax; and

- Ride Share Providers

The beginning of a new financial year brings with it the prospect of (hopefully) a nice little (or big) refund into your bank account when you lodge your income tax return. For some, it might be the opposite and you have tax payable when your tax return is lodged.

Whichever position you find yourself in this tax time, it’s important to remember that the ATO is continuing to expand its data-matching capabilities to ensure that the taxpayers don’t leave out income or inflate deductions.

Rental Property Deductions – Landlords Take Note!

The ATO‘s review of income tax returns shows nine in ten rental property owners are getting their returns wrong, and often see rental income being left out, or mistakes being made with property-related deductions – like over-claiming expenses or claiming for improvements to private properties.

The ATO is particularly focused on interest expenses and ensuring that rental property owners understand how to correctly apportion loan interest expenses where part of the loan was used for private purposes (or the loan was re-financed with some private purpose).

As we mentioned above, the ATO has sophisticated data matching capabilities which include rental property-related data and has recently implemented a new residential investment property loans data mating program.

Work-Related Expenses – No ‘Copy + Pasting’ When Working From Home

This year, the ATO is also particularly focused on ensuring that taxpayers understand the changes to the working-from-home methods and can back up their claims.

To claim your working-from-home expenses as a deduction, you can use the actual cost, or the revised fixed rate method, so long as you meet the eligibility and record-keeping requirements.

Missed our previous article where we go into detail on the changes to claiming working-from-home deductions? Check it out here: Changes To Claiming Working From Home Deductions.

Hot Tip: don’t forget the downloadable, it’s going to make your phone appointment or walk-in tax return a breeze!

Capital Gains Tax

Capital Gains Tax (CGT) comes into effect when you dispose of assets such as shares, cryptocurrency, managed investments and/or properties. To ensure that you are meeting your obligations and paying the right amount of tax, you need to calculate a capital gain or a capital loss for each asset you dispose of unless an exemption applies.

It’s important to note that generally, your main residence is exempt from Capital Gains Tax, however, if you have used your home to produce income, such as renting out all or part of it through the sharing economy, for example, Airbnb, or running a business from home, then Capital Gains Tax may apply.

Not sure where to start if you’ve been renting out your house on Airbnb? Check out this previous article we put together: Renting Out Your House On Airbnb… What About Tax?

As always, the ATO is reminding taxpayers of the importance of keeping records of the income-producing period and the portion of the property used to produce income to calculate the capital gain. If you used the property to earn income and qualify for an exemption, make the election in your income tax return.

Data Matching

As the ATO continues to expand its data-matching capabilities, new data is rolling into the ATO from property managers, landlord insurance providers, financial institutions providing loans for residential investment properties and ride share economy providers, as well as income protection policy information.

Residential Investment Property Loans + Landlord Insurance

With the new landlord insurance data-matching protocol, the ATO is reminding taxpayers that insurance premiums paid for rental properties can be claimed as a tax deduction. Similarly, insurance payouts received in relation to an investment property must be reported as income.

Fun Fact: according to the ATO, 87% of taxpayers who own rental properties use a registered tax agent to lodge their income tax return. It is important taxpayers provide their agent, with the right information to prepare their income tax return correctly. Taxpayers are ultimately responsible for what they include in their tax returns, even when using an agent.

Sharing Economy Reporting Regime (SERR)

Record numbers of taxpayers are now working multiple jobs or supplementing their income with side hustles or ride-sharing economy activities.

The SERR starts from 1 July 2023, requiring more electronic distribution platforms to report payment information to the ATO. This will come into effect in two phases:

- Electronic distribution platforms that provide taxi services, ride-sourcing, and short-term accommodation must report income data from 1 July 2023; and

- All other electronic distribution platforms must report from 1 July 2024.

The information from platforms will be matched against what is reported in income tax returns or activity statements.

Income Protection Insurance

The new income protection data-matching protocol was published this month, meaning the ATO will know premiums paid for income protection insurance policies as well as payouts received.

Generally speaking, you can claim a tax deduction for income protection insurance you purchase, but you can’t claim the deduction if the income insurance policy is paid by your superannuation fund.

If you receive an income protection insurance payout from either your personal insurance policy or from your superannuation fund policy, you must include the income received in your income tax return.

What else to be careful with this Tax Time…?

Motor Vehicle + Car Expenses

Expenses for a Car You Own or Lease

To claim a deduction on your income tax return for car expenses:

- Your vehicle must meet the definition of a car

- You must own or lease the car

- You do not own or lease the car if you use it under a salary sacrifice or novated lease arrangement

- The expenses must be for work-related trips

- You can claim for trips between workplaces or to perform your work duties

- You can’t claim for trips between your home and place of work, except in limited circumstances

- You must have spent the money yourself and not be reimbursed

- You must have the required records

You can use either of two methods to calculate deductions for car running expenses:

To calculate your deduction, multiply the number of work-related kilometres you travel in the car by the rate per kilometre for that income year. ‘Work-related kilometres’ are the kilometres your car travels in the course of earning your assessable income.

- Use the rate for the income year for which you are claiming a deduction:

- 2022-23: use 78 cents per kilometre

- 2020-21 and 2021-22: use 72 cents per kilometre

- You can claim a maximum of 5,000 work-related kilometres per car

- You need to keep records that show how you work out your work-related kilometres.

If you and another joint owner use the car for separate income-producing purposes, you can each claim up to 5,000 work-related kilometres.

If you use the cents per kilometre method, you don’t need receipts, however, you do need to be able to show that you own the car and how you work out your work-related kilometres. For example, in a detailed diary.

To calculate your deduction using the logbook method, you need to:

- Keep a logbook that shows your work-related trips for a continuous period of at least 12 weeks (your logbook is valid for up to five income years). You must record every km, both work-related and private;

- Keep receipts or other records of your car expenses; and

- Use your logbook to calculate the deductible portion of your car expenses.

Keeping a logbook, you must:

- Cover at least 12 continuous weeks and be broadly representative of your travel;

- Include the destination and purpose of every journey, the odometer reading at the start and end of every journey, and the total kilometres travelled during the period; and

- Include odometer readings for the start and end of the logbook period.

Your logbook is valid for five years. However, if your circumstances change (for example, if you change jobs or move to a new house), and the logbook is no longer representative of your work-related use, you will need to complete a new 12-week logbook.

In each of the four years following the first year, you need to keep:

- Odometer readings for the start and end of the full period you claim; and

- Your work-related percentage based on the logbook.

Notice of Intent to Claim A Superannuation Deduction

If you are making or have made personal superannuation contributions over the last financial year and are intending to include this in your income tax return to be able to claim a tax deduction, there are a few things you need to know.

You may be able to claim a deduction for personal superannuation contributions that you made to your superannuation fund or RSA provider from your after-tax income, for example, from your bank account directly to your superannuation fund.

You cannot claim a deduction for superannuation contributions paid by your employer directly to your superannuation fund or RSA provider from your before-tax income such as:

- The compulsory superannuation guarantee;

- Salary sacrifice; and

- Reportable employer superannuation contributions are shown on your annual payment summary.

Before you can claim a deduction for your personal after-tax superannuation contributions, you must have:

- Given your superannuation fund or RSA providers a Notice of intent to claim or vary a deduction for personal super contributions, and

- Received an acknowledgement from your superannuation fund or RSA provider.

Canny Accounting + Your Income Tax Returns

Canny Accounting has been assisting our clients, near and far with their tax obligations for over 60 years. We are well versed in income tax returns and working with you to be able to achieve the best outcome possible when lodging your tax returns.

We are across all cryptocurrency matters and can help you along the way in your investing journey when it comes to lodging your returns as well as advise on any capital gains tax advice you may need.

Get in touch with our team to have a chat and lodge your income tax return correctly this financial year. Want to know ahead of the cue? Head to our website to book to have your income tax return completed via a phone appointment with one of our accountants!