Changes To The Victorian WorkCover Scheme – Getting Victorians Healthy + Back To Work

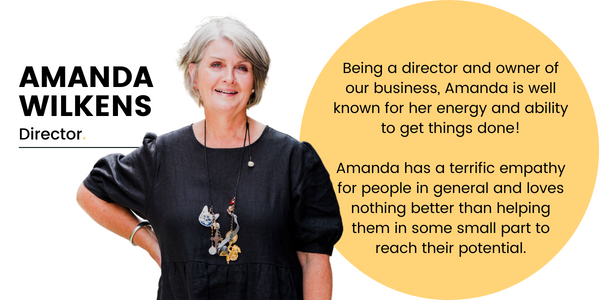

Written by: Amanda Wilkens l Accounting Team

The Victorian Government recently announced changes to the average rate used to calculate WorkCover premiums for 2023-24, along with some proposals for changes to eligibility and entitlements.

The Government has been consulting with stakeholders on ways it can modernise the scheme to ensure it is fit for purpose. So, let’s take a deeper look…

What Is WorkCover?

The WorkCover scheme is a system of state-based, compulsory insurance that provides a range of entitlements to workers and insures employers against the impact of economic and non-economic loss suffered by workers.

WorkSafe acts as the regulator and the underwriter of the WorkCover scheme. It administers the scheme through private service providers, referred to as Agents, who are authorised by WorkSafe to provide services to employers and workers in accordance with the legislation and standards and procedures set by WorkSafe.

As per the WorkCover Scheme, section 1.1.1 Objection of the Victorian WorkCover Scheme, the main objectives of the Victorian WorkCover Scheme are to:

- Reduce the incidence of accidents and diseases in the workplace;

- Make provision for the effective occupational rehabilitation of injured workers and their early return to work;

- Increase the provision of suitable employment to workers who are injured workers in the most socially and economically appropriate manner, as expeditiously as possible;

- Ensure workers compensation costs are contained so as to minimise the burden on Victorian businesses;

- Establish incentives that are conducive to efficiency and discourage abuse;

- Enhance flexibility in the system and allow adaptation to the particular needs of disparate work situations;

- Maintain a fully funded scheme; and

- In this context, to improve the health and safety of persons at work and reduce the social and economic costs to the Victorian community of accident compensation.

Changes to WorkCover for 2023-24

The Government plans to modernise the scheme through three key reforms:

1. Premiums

The Victorian Government has confirmed the average rate used to calculate WorkCover premiums will be set at 1.80% for the 2023-24 financial year and will take effect from 1 July.

The average premium rate is a general figure only. The actual rate varies for individual employers based on their sector, size and workers compensation claims history.

2. Eligibility Changes

The proposed Eligibility Changes are required to be ratified through Parliament so there may be adjustments, as well as confirmation on effective dates.

Mental Injury Claims: it is intended that workers with stress and burnout claims will no longer be able to access weekly payments from WorkCover. Instead, workers will be able to access provisional payments for 13 weeks to cover medical treatment, alongside enhanced psychosocial support to help them return to the workplace or training pathways.

130 Week Plus Claims: to align with other states and territories, WorkSafe will update the test for workers who have been receiving weekly benefits for two and a half years, to more objectively measure the degree of physical and mental impairment alongside work capacity.

This change, if approved, will require a Whole Person Impairment of greater than 20% alongside the capacity test for a worker to continue receiving weekly benefits after two and a half years.

3. Establishing Return to Work Victoria

WorkSafe is introducing an organisation called ‘Return to Work Victoria’, intended to bring a dedicated focus to piloting initiatives designed to improve return to work and prevention outcomes.

Return to Work Victoria aims to reduce the adverse health and social impacts associated with long-term worklessness, ensuring that every worker who is injured at work has access to the support they need to rehabilitate and get back to work.

Who Is Eligible for WorkCover In Victoria?

In Victoria, employers must register for WorkCover insurance if:

- Their annual rateable remuneration (wages and benefits paid to workers) is greater than $7,500; or

- They employ apprentices or trainees.

If a work-related illness or injury has occurred, a worker can claim two things:

- Reasonable expenses associated with the treatment of the illness or injury; and

- Weekly payments compensating the employee for loss of income due to the illness or injury. How much is paid is calculated on the worker’s average weekly earnings prior to the injury.

Work-related injury/illness

The legislation provides that an injury can provide an entitlement to compensation if it arises “out of the course of any employment”.

This definition is broadly worked – there is no single definition of what will and will not be deemed to be a work-related injury. The legislation does provide some clarity by listing several examples, deemed to be “in the course of employment”, such as where the worker is travelling for the purpose of their employment, or where they are injured whilst attending a compulsory training course.

WorkCover FAQs

Do I Need To Have WorkCover Insurance?

WorkCover insurance is compulsory if you employ one or more workers in Victoria and pay, or expect to pay, more than $7,500 in remuneration in a financial year, or if you engage apprentices and trainees.

How Is My WorkCover Insurance Premium Calculated?

Employer premiums are calculated as a percentage of the annual remuneration paid to workers. If your total remuneration is $200,000 or less, you will pay a premium based on an industry rate.

There are over 500 WorkCover industry rates which are determined by the relative risk profile of each industry.

If your remuneration is more than $200,000 your individual workers compensation claims experience will also be taken into account.

How Does Employer Rate Capping Work?

Capping limits the percentage an existing employer’s premium rate can increase in a single year.

For 2023-24, an employer’s premium rate cannot increase by more than 75% from the previous year, for their existing workplaces. This cap takes into account the rise in the average premium rate.

What Can I Do To Reduce The Amount of Premium I Pay In The Future?

The best way to ensure you pay the lowest premium is to operate a safe and healthy workplace to prevent injuries from occurring. However, if injury or illness does occur, focusing on achieving a prompt and sustainable return to work outcome will assist in keeping premiums down.

You can also pay your premiums early to receive either a 3% or 5% discount by certain dates.

Canny Accounting – The Expert Accountants Geelong

Canny Group have been assisting businesses, big and small, for over 60 years to ensure that they are up-to-date with their tax requirements but also that they are maintaining their legal requirements.

Our team of accountants are able to assist you with the set-up and maintenance of your business to ensure that you are meeting all of your legal requirements from the get-go and when they need to be reviewed. We do this because we understand that being in business can sometimes, be a bit overwhelming.

Get in touch with our team today to make sure that your business is running smoothly and correctly!