GST + The National Disability Insurance Agency… Do We, Can We, Should We?

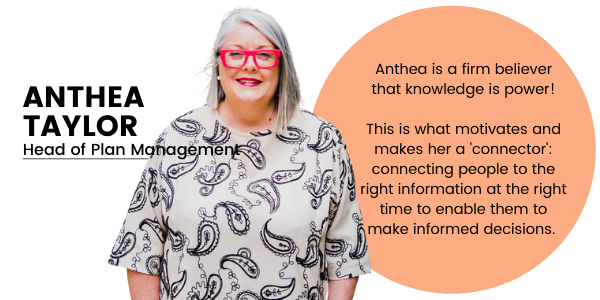

Written by: Anthea Taylor l NDIS Plan Management Team

This time last year, we wrote about tax and the National Disability Insurance Scheme (NDIS). With one financial year having just ended, and a new one upon us, it is the perfect time to revisit the issue of NDIS and tax.

The funding provided by the National Disability Insurance Agency (NDIA) for use by National Disability Insurance Scheme (NDIS) participants is to enable participants to engage and purchase supports to assist with working towards and achieving the goals in their plans. The funding is allocated to the NDIS Participant in the form of their individual and personal NDIS Plan. Whilst the funding is an individual allocation, it is not income. And as it’s not income, it is tax-exempt.

A participant’s NDIS Funding is calculated and based on the reasonable and necessary supports the National Disability Insurance Agency deems the individual NDIS Participant will require to assist with working towards and achieving their goals. The funding is not means-tested, is not a replacement for any form of income and does not impact any pension the NDIS Participant may be on and receiving. As National Disability Insurance Scheme funding is not income, NDIS Participants can’t claim expense deductions or claim assets provided through their NDIS Funding.

Although the funding itself is not taxable, how it is used, and who it is paid to is a different issue. Hello GST – yes, no, maybe? In the words of the National Disability Insurance Agency “many, but not all, NDIS supports to NDIS Participants are GST-free”. In true National Disability Insurance Agency fashion, the vagueness of this statement confuses NDIS Participants and providers alike. They are expected to refer to, read, understand and comply with both the NDIS Pricing Arrangements and Price Limits, and the Australian Tax Office’s requirements for the NDIS + GST.

What About Registered And Non-Registered Providers?

The providers of supports and services delivered to NDIS Participants are many and varied. At the last count, there were over 40,000 providers listed on the NDIS Provider Finder (Registered Providers only). Add this to all the non-registered providers, we are talking many tens of thousands of providers. Like all businesses, big or small, they all have one thing in common: charging for their services and wanting to be paid. Confusion arises around do we, can we, should we be charging GST?

The utilisation of an NDIS Participant’s funding is subject to their plan and the supports determined to be reasonable and necessary in context to their funded disability and the goals in their NDIS Plan. For agency and NDIS Plan Management participants, the amounts payable to providers of supports are subject to maximum payable rates as set by the National Disability Insurance Agency. This is governed by the rules set out in the National Disability Insurance Scheme Pricing Arrangements and Price Limits which outlines the maximum rates payable for supports delivered to NDIS Participants to ensure value for money.

There is a misconception that the rates in the Pricing Arragenemtns and Price Limits are the rates providers must charge. Incorrect! The rates are maximum payable rates. No more, but definitely can be less. NDIS Plan Management participants can negotiate a lower rate with their provider(s) enabling them to get more out of their funding.

Manage Your Funding With A New Tax System…

The A New Tax System (Goods and Services Tax Act) 1999 was amended to include the provisions for disability supports provided to NDIS Participants, and subsequently the criteria required to be met in order for a support or services to be GST-free. Last year we likened GST to Hamlet’s soliloquy “to be or not to be…” To charge GST or not, remains in the top ten queries we as NDIS Plan Managers receive from providers.

Under the Goods and Service Tax Act, s38-38, a disability support provided to NDIS Participants must meet four requirements to be eligible to be GST free:

A supply is GST-free if the supply:

(a) is a supply to a participant (within the meaning of the National Disability Insurance Scheme Act 2013) for whom a participant’s plan is in effect under section 37 of the Act.

The NDIS Participant receiving the support must have or had an active (NDIA) approved NDIS Plan at the time the supports were delivered. An NDIS Plan becomes inactive when it is replaced by a new NDIS Plan or when the NDIS Participant ceases being a participant of the National Disability Insurance Scheme.

(b) is a supply of one or more or the reasonable and necessary supports specified in the statement included, under subsection 33(2) of the Act, in the participant’s plan.

The supports are to be reasonable and necessary for an NDIS Participant’s funded disability and align with the goals and supports specified in the participant’s NDIS Plan.

(c) is made under a written agreement, between the supplier and the participant or another person that (i) identifies the participant; (ii) states that the supply is a supply of one or more reasonable and necessary supports in teh statement included, under subsection 33(2) of the Act, in the participant’s plan.

There must be a written agreement between the provider and the NDIS Participant or another person acting on behalf of the NDIS Participant or another person acting on behalf of the participant such as their plan nominee, support coordinator or representative. The National Disability Insurance Agency recommends NDIS Participants have written Service Agreements with providers, however with the exception of Specialist Disability Accommodation, a formal written Service Agreement is not mandatory.

To satisfy the requirements of the GST Act, the written agreement can be in the form of a formal service agreement as recommended, but can also be in the form of written correspondence between the parties. It needs to identify the NDIS Participant as the recipient of the service or support, and ensure it aligns as the reasonable and necessary support in context with the NDIS Participant’s funded disability and the NDIS Plan for which it is being provided.

At Canny Plan Management, we agree with the National Disability Insurance Agency recommending that NDIS Participants have service agreements in place with their providers as a way of a record of the agreed supports. In addition to the types of supports and rates, many of the supports cited in the NDIS Pricing Arrangement and Price Limits allow for claims for non-direct supports. Providers, however, must not claim for these non-direct supports such as travel and transport costs, telehealth, non-face-to-face, report writing, or shore notice cancellation without agreement from the NDIS Participant in advance. It is advisable that these be included in the service agreement.

(d) is of a kind that the Disability Services Minister has determined in writing.

The Minister’s Determination, like the NDIS Act and the GST Act, is a legislative instrument. It identifies the types of services and support for NDIS Participants which are GST-free. These include:

- Specialist Disability Accommodation and accommodation/tenancy assistance

- Assistance in coordinating or managing life stages, transitions and supports, including daily tasks in a group or shared living arrangements

- Household tasks

- Assistance with and training in travel/transport arrangement, excluding taxi fares

- Interpreting and translation

- Assistance to access and maintaining education and employment

- Assistive equipment for recreation

- Early intervention supports for early childhood

- Management of funding for supports in a participant’s plan

- Assistance with daily personal activities

- Specialised assessment and development of daily living and life skills, including community participation

- Assistive equipment for general tasks and leisure, including assistive technology specialist assessment, set up and training

- Behavioural support and therapeutic supports

- Home modifications

The Minister’s Determination also identifies exclusions to GST-free supports, such as taxi fares. If GST is applicable to a reasonable and necessary support identified in an NDIS Participant’s Plan, the price limits in the NDIS Price Guide are inclusive of GST.

The current Minister’s Determination applies from 1 July 2021 with the intention that it remain in force up to 30 June 2025 unless otherwise repealed.

NDIS Plan Management + GST For Your Provider Invoices

Please note that this blog does not constitute as advice. The Australian Tax Office (ATO) provides guidance on the GST treatment for the provision of supports to NDIS Participants and detailed information can be found in the Explanatory Statement accompanying the Minister’s Determination.

Any provider requiring assistance with tax law compliance, unsure about the GST-free eligibility for Service Agreements should seek financial and legal advice. Get in touch with our team today and let our Accounting Team and our Legal Team help you get the advice and clarification that you need to better your business.