How Does Transition To Retirement Work?

Written by: Samantha Butcher l Advisory Team

Deciding when to retire is a deeply personal decision and there are many common factors that can generally influence the retirement decision for most people including health, friends and family, ability to continue in your job, and financial independence.

Health considerations can relate to yourself or someone that you care for. For example, you may experience a health scare or be diagnosed with something that means you can no longer do your job. Alternatively, you may also decide to retire to care for a loved one.

In relation to work, you may be finding the demands of your work are becoming more tiring as you are getting older, or you are unable to find work as a result of redundancy or you’re at the end of a work contract.

For others, seeing their friends and family enjoying their retirement years can make their own retirement increasingly more appealing.

For some, it will be their financial situation that makes them seriously consider retirement. It might be that you have reached the age pension age, receive a financial windfall, or find that you have more financial resources available after your children have left the family home.

With that in mind and all of the considerations that can generally influence the retirement decision for most people, we want to take you through the transition to retirement and how it works.

What is Transition to Retirement (TTR)?

Transition to retirement (TTR) allows you to access your superannuation while you are still working. It is ideal for those who are approaching retirement and who want to start reducing their working hours whilst still maintaining their income.

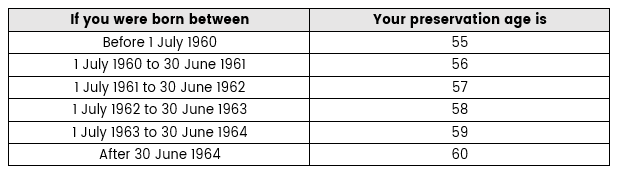

Under the transition to retirement rules, when you reach your preservation age, you may be able to reduce your working hours without reducing your income and you can do this by choosing to start a transition to retirement income stream (TRIS).

The transition to retirement income stream tops up your part-time income with a regular ‘income stream’ from your superannuation savings. Previously, you could only access your superannuation once you had reached 65 years old or were retired.

Under these rules, you can only access your superannuation benefits as a ‘non-commutable’ income stream. A non-commutable income stream is one that you can’t convert into a lump sum. This generally means that you can’t take your benefits as a lump sum cash payment while you are still working. You must take your superannuation benefits as regular payments.

Employers still need to make compulsory superannuation guarantee contributions for all their eligible employees and this includes those who are on a transition to a retirement income stream.

What Are The Transition To Retirement Rules?

Generally, the only eligibility requirements for a transition to retirement are that you need to be at your preservation age, still be working and have an eligible superannuation fund.

To begin your transition to retirement, you will need to open a transition to retirement account, which is generally an Account Based Pension, alongside your superannuation. This will involve transferring a portion from your superannuation accounting into this Account Based Pension.

Once this has been set up and completed, you will receive regular payments from the pension. There is a minimum required payment from the pension. The minimum is a percentage of your balance (recalculated every year) and is determined by your age. The maximum you can withdraw is 10% per annum. It is important to note that you are not able to receive a lump sum payment from this pension account.

Advantages of Transition to Retirement

If you are over 60 years old, then payments from your transition to retirement are tax-free. However, if you are aged between 55 and 59 years old, the payments are taxed at their marginal tax rate, with a 15% tax offset.

You can also continue to grow your superannuation through both your superannuation guarantee payments from your employer as well as through your concessional (pre-tax) and non-concessional (post-tax) contributions.

Disadvantages of Transition to Retirement

One possible disadvantage that you might find yourself facing is that you will need to negotiate your change of working hours with your employer. It’s important to have a healthy relationship with your employer and to be transparent when it comes to your retirement and how you see it transpiring, so there can be transparency between both parties.

Centrelink – if you have a partner and they are receiving the Aged Pension, they will need to notify Centrelink of the change to your assets which could possibly affect the payments that they receive.

Retirement Planning + What You Need To Consider

Some important things to consider for your transition to retirement are first and foremost if you hold any insurances within your superannuation fund(s). You will need to check with your financial adviser or your superannuation fund(s) to make sure if there will or won’t be any changes to the cover you hold, if any.

Secondly, a very important consideration is whether your superannuation balance is enough to see you through your retirement years. Our team at Canny Advisory specialise in retirement planning and this is just one step you can take to ensure that you are armed with the advice and the knowledge you need to make it through your retirement needs.

Canny Advisory + Your Transition to Retirement Advice

Canny Advisory are zealous about helping our clients set and achieve their financial goals in the now as well as in the future.

Our Advisory team specialise in a variety of areas that help you to improve and gain control of your financial situation – especially when it comes to planning for your retirement. These are your golden years and we want you to be able to enjoy each and every one of them and know that you are in the best position possible.

Get in touch with our team if you want to have a chat about your transition to retirement and how this is going to work for you, so we can work together to put your transition to a retirement plan in place.