Start Retirement Planning Now, So You Can Be Rewarded Later

Written by: Samantha Butcher l Advisory Team

Australians are living longer than ever – and that’s a good thing!

According to REST Industry Super Chief Executive Officer, Damian Hill.

Less than 100 years ago, a retiree wasn’t expected to draw a pension, but today we will need money for more than 15 years after we retire. Beyond the pressure this puts on the Age Pension system, our increased longevity poses problems that aren’t easy to address. As politicians regularly point out, an ageing population puts pressure on housing, healthcare and perhaps most importantly, our families.

So what can you do to help ease the pressure for your well-earned golden years? We want you to start retirement planning now so that you can be rewarded later.

Who, what, when and where do you start retirement planning? The simple answer to all of those questions is to see our team at Canny Advisory.

The Best Type of Retirement Plan

What do you want your retirement plan to look like? Does it include a caravan, does it include those house renovations that you’ve been putting off, does it include volunteering work or does it include a long well-earned cruise? The opportunities are endless but our team want you to be as prepared as possible for your retirement.

It is important that you start as early as possible to give yourself the best chance at making your dreams a reality, and that’s what our team at Canny Advisory are here to help you do. We make this journey easy, stress-free and most importantly, tailored to you!

It’s easier than not to put off thinking about your retirement when reaching the right age seems like many moons away, but as each year passes and you bring in a new year and another lap around the sun it starts to become more and more of a reality but it’s not something that should be feared!

Understanding What Your Retirement Needs Are With The Help of Financial Advisory Services

Do you know where you stand financially when it comes to your retirement?

Knowing the answer to this question, as well as having clearly thought-out goals that you would like to achieve in your life, will make the planning side for your retirement years that much easier.

Before you do either – ask yourself these questions, and be honest with your answers:

- What is your risk tolerance?

- What is your cash liquidity preference?

- What is your timeline to retirement?

- What type of retirement lifestyle do you want?

Your answer to the above questions will give our team at Canny Advisory a greater understanding of the steps that need to be taken and explored when it comes to tailoring your retirement plan for you.

Getting Your Retirement Age Right

A common question that we are frequently asked is:

What is the retirement age in Australia?

According to the Australian Bureau of Statistics, the average age at retirement for recent retirees (those who have retired in the last five years) was approximately 63 years old.

When it comes to working out your retirement age, there are two other important ages that need to be considered: age pension age and preservation age – when you can start to access your superannuation.

- Age Pension Age

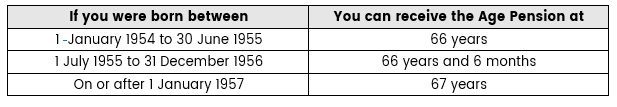

This is the age that you qualify to receive the age pension benefits from the Government. The current age pension age is 66.5 years but this could be higher based on your date of birth, see below;

There are, however, some income and assets tests that you must be able to meet in order to be eligible to receive the age pension which our team can talk you through and help you to understand the process.

- Preservation Age

This is the age when you can start to access your superannuation – your hard-earned retirement money. Everyone has full access to superannuation at age 65.

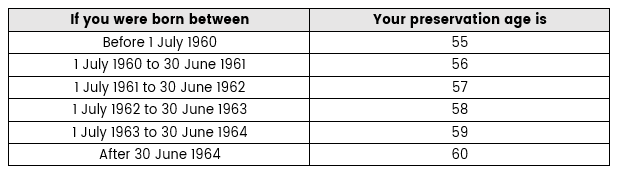

If, however, you are under 65 years old, you can generally access your superannuation if you have retired from the workforce and reached your ‘preservation age’. Your preservation age depends on the year you were born, see below;

Australians are living longer than ever, so chances are, you could spend a very long time in retirement. Canny Advisory are leaders in their field of retirement planning to ensure that your retirement savings last as long as you need them to. Our team is well versed in helping our clients with understanding how to apply for the age pension and also to help them ensure that their superannuation is going to last once they have reached their preservation age.

Financial Professionals to Help Plan Your Superannuation Strategy

Superannuation is designed to provide us with retirement income (or at the very least a top-up to the age pension). The good news is that superannuation is still one of the most tax-effective ways to invest in this country.

We can guarantee that while you’re on your way to your retirement you’ve heard of the term superannuation – or super, as it’s more commonly referred to and have a general understanding of how it works as well as what it has to do with your retirement.

Beyond that, however, the average Australian likely doesn’t know much about the details of superannuation apart from the fact that your employer pays a percentage of your income to your nominated superannuation fund for your retirement. As superannuation forms a critical part of a successful retirement plan, it’s important to have a strategy in place for when it comes to accessing it and making it last the entirety of your retirement years.

There are a number of strategies that can be utilised and put in place to ensure that you’re making the most out of your superannuation to achieve your retirement goals.

Want to know how to Get The Most Out Of (In To) Super? We’ve put this article together to cover all the options for maximising your superannuation savings.

Have You Set Your Financial Goals To Know How Much Money You Need To Retire?

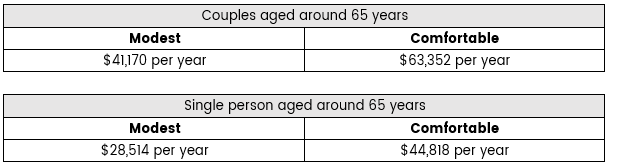

The retirement standard is calculated and published every quarter by the ASFA to help retirees prepare themselves financially for retirement and to budget for their future once they are in retirement. It gives an estimate of the total annual cost of living either for a comfortable or modest lifestyle for both retired singles and couples that are aged 65 years to 85 years, as well as over 85’s.

*Source: The Association of Superannuation Funds of Australia (ASFA) – Retirement Standards, June quarter 2021.

However, it is extremely important to understand that everyone’s idea of retirement is different and the above figures do not take into account your personal circumstances. This is why we recommend that you speak to our team at Canny Advisory to ensure that you’re on track to live your best retirement lifestyle.

Want to know How To Financially Prepare for Retirement? We have put together this article which goes over in detail how much you need on average to retire for both couples and singles and takes into consideration some very basic lifestyle choices.

Retirement Planning with Canny Advisory

The importance of retirement planning is up to you – how do you envisage your retirement? Saving for retirement should be a primary goal for all of us.

Retirement Planning for some people can be the great unknown – when can I retire? How much do I need? What can I do to put myself in a better financial position?

Canny Advisory is more than just an advisory firm offering financial advice, we are experts in our field of self-managed super funds, retirement planning, investment management and advice as well as aged care. So wherever you are in your retirement journey – if you are looking to improve and gain control of your situation on the way to your retirement as well as make sure that you have the right protection in place for what life has in store for you, get in touch today!